WNXM vs MANA: A Comparative Analysis of Two Promising Cryptocurrency Projects

Introduction: WNXM vs MANA Investment Comparison

In the cryptocurrency market, the comparison between WNXM vs MANA has always been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different crypto asset positioning.

WNXM (WNXM): Since its launch, it has gained market recognition for its risk-sharing model in decentralized insurance.

Decentraland (MANA): Launched in 2017, it has been hailed as a pioneer in blockchain-based virtual worlds, becoming one of the most prominent projects in the metaverse space.

This article will comprehensively analyze the investment value comparison between WNXM vs MANA, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question most concerning investors:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

WNXM and MANA Historical Price Trends

- 2021: WNXM reached its all-time high of $130.82 on May 13, 2021.

- 2021: MANA surged to its all-time high of $5.85 on November 25, 2021, likely due to increased interest in metaverse projects.

- Comparative analysis: During the market cycle, WNXM dropped from its high of $130.82 to a low of $7.78, while MANA fell from $5.85 to its current price, showing significant volatility in both assets.

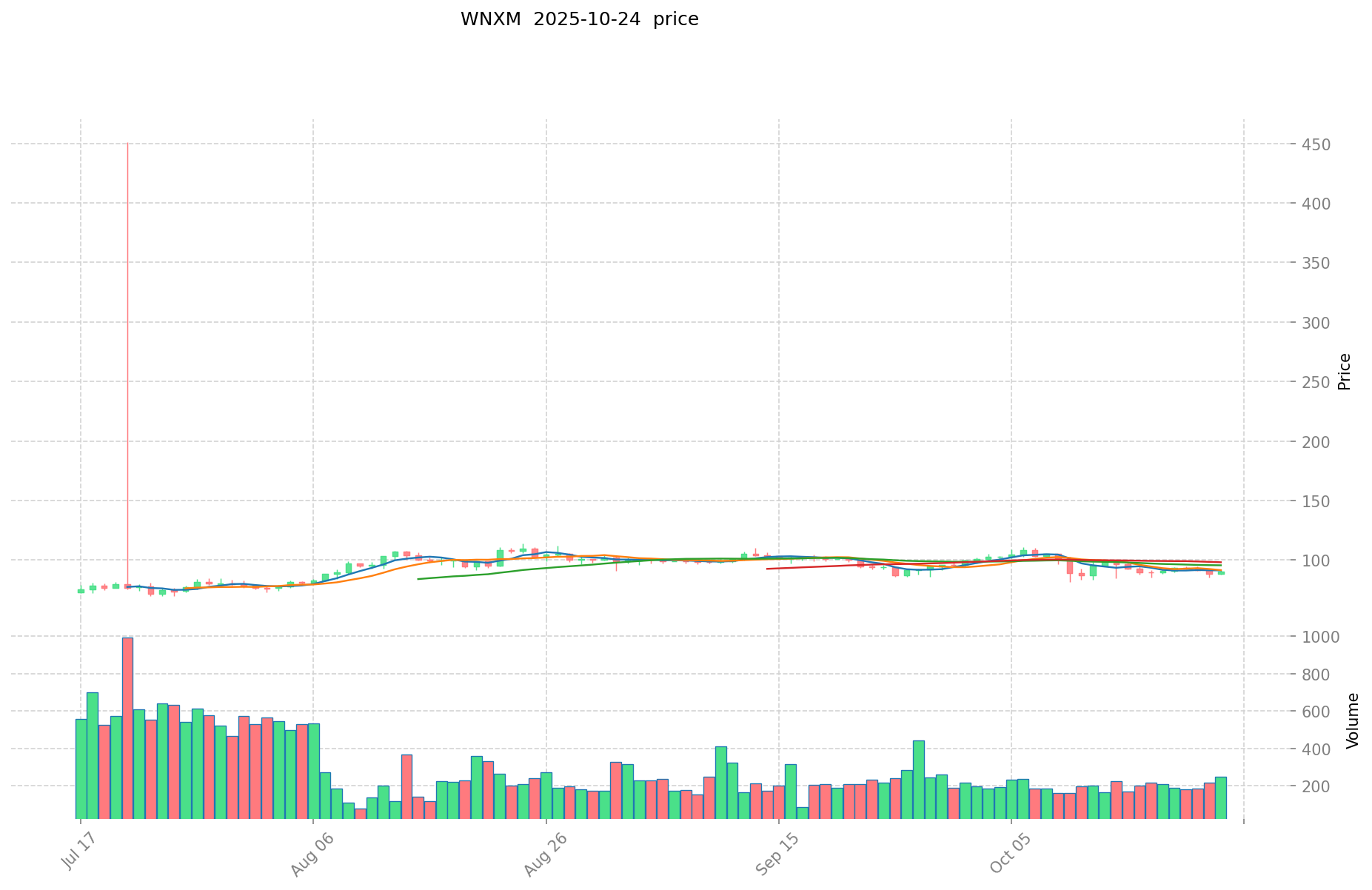

Current Market Situation (2025-10-24)

- WNXM current price: $90.4

- MANA current price: $0.2349

- 24-hour trading volume: WNXM $22,018,716 vs MANA $206,018,941

- Market sentiment index (Fear & Greed Index): 30 (Fear)

Click to view real-time prices:

- View WNXM current price Market Price

- View MANA current price Market Price

II. Project Overview and Technology Comparison

WNXM (Wrapped NXM)

- Introduction: WNXM is a wrapped version of NXM, the native token of Nexus Mutual.

- Core technology: Represents a 1:1 wrapped token of NXM on the Ethereum blockchain.

- Key features:

- Provides liquidity for NXM tokens

- Allows trading on decentralized exchanges

- Maintains peg to NXM token value

MANA (Decentraland)

- Introduction: MANA is the native token of Decentraland, a decentralized virtual reality platform.

- Core technology: Built on Ethereum blockchain, powering a virtual world ecosystem.

- Key features:

- Used for purchasing virtual land (LAND) in Decentraland

- Governance token for Decentraland DAO

- In-platform currency for goods and services

Technology Comparison

- Blockchain: Both tokens operate on the Ethereum network

- Use case: WNXM focuses on decentralized insurance, while MANA is central to a virtual world economy

- Market positioning: WNXM serves a niche in DeFi, MANA targets the broader metaverse and gaming sector

III. Market Performance Analysis

WNXM Market Data

- Market Cap: $45,328,206

- Circulating Supply: 501,418 WNXM

- 24h Trading Volume: $22,018,716

- Price change (24h): +2.38%

MANA Market Data

- Market Cap: $450,809,682

- Circulating Supply: 1,919,155,736 MANA

- 24h Trading Volume: $206,018,941

- Price change (24h): +2.36%

Comparative Analysis

- Market Cap: MANA's market cap is significantly larger, indicating higher overall valuation

- Liquidity: MANA shows higher trading volume, suggesting better liquidity

- Price Movement: Both tokens show similar positive 24-hour price changes

IV. Investment Considerations

Potential Opportunities

- WNXM:

- Growth potential in the DeFi insurance sector

- Limited supply may lead to price appreciation with increased demand

- MANA:

- Expanding metaverse adoption could drive demand

- Potential for partnerships and integrations in the virtual world space

Potential Risks

- WNXM:

- Dependency on Nexus Mutual's success and adoption

- Regulatory risks in the insurance sector

- MANA:

- Competition from other metaverse projects

- Volatility in the broader crypto market

Investment Strategy Suggestions

- Diversification: Consider allocating investments across both assets to balance risk

- Research: Stay informed about developments in DeFi insurance and metaverse sectors

- Risk Management: Set clear entry and exit points based on individual risk tolerance

- Long-term Perspective: Both projects are in evolving sectors, requiring patience for potential growth

V. Conclusion

WNXM and MANA represent different sectors within the cryptocurrency ecosystem. WNXM offers exposure to the growing DeFi insurance market, while MANA is positioned in the expanding metaverse space. Both tokens have shown significant volatility but also potential for growth. Investors should carefully consider their risk tolerance and conduct thorough research before making investment decisions. The current market sentiment indicates a cautious approach may be prudent.

II. Core Factors Affecting Investment Value of WNXM vs MANA

Supply Mechanism Comparison (Tokenomics)

- WNXM: Project team's execution level significantly impacts value

- MANA: Community support and social recognition influence valuation

- 📌 Historical pattern: Market bubbles and potential risks exist similar to luxury markets

Institutional Adoption and Market Applications

- Institutional holdings: Data insufficient to determine preference

- Enterprise adoption: Project building efforts crucial for both tokens

- Regulatory attitudes: Information not provided in the reference material

Technical Development and Ecosystem Building

- Community efforts: Community contributions have limited impact if project teams don't actively build (as demonstrated by AZUKI example)

- Ecosystem comparison: NFT market contains bubbles and potential risks similar to luxury goods markets

Macroeconomic and Market Cycles

- Market volatility: Both tokens subject to overall cryptocurrency market trends

- DeFi lending trends: DeFi lending has reached historic highs, surpassing CeFi (mentioned in Alpaca Finance news)

- Ethereum ecosystem: ETH price predictions suggest 2500% potential growth, which may affect the broader ecosystem including these tokens

III. 2025-2030 Price Prediction: WNXM vs MANA

Short-term Prediction (2025)

- WNXM: Conservative $57.86 - $90.41 | Optimistic $90.41 - $114.82

- MANA: Conservative $0.225 - $0.235 | Optimistic $0.235 - $0.345

Mid-term Prediction (2027)

- WNXM may enter a growth phase, with prices expected in the range of $57.38 - $150.48

- MANA may enter a volatile phase, with prices expected in the range of $0.177 - $0.391

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- WNXM: Base scenario $161.24 - $185.34 | Optimistic scenario $185.34 - $272.44

- MANA: Base scenario $0.419 - $0.518 | Optimistic scenario $0.518 - $0.730

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making any investment decisions.

WNXM:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 114.8207 | 90.41 | 57.8624 | 0 |

| 2026 | 113.9030385 | 102.61535 | 58.4907495 | 13 |

| 2027 | 150.4802800075 | 108.25919425 | 57.3773729525 | 19 |

| 2028 | 190.1735135792625 | 129.36973712875 | 71.1533554208125 | 43 |

| 2029 | 210.89854546728825 | 159.77162535400625 | 124.621867776124875 | 76 |

| 2030 | 272.442575553651457 | 185.33508541064725 | 161.241524307263107 | 105 |

MANA:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.345009 | 0.2347 | 0.225312 | 0 |

| 2026 | 0.402897755 | 0.2898545 | 0.234782145 | 23 |

| 2027 | 0.391405024075 | 0.3463761275 | 0.176651825025 | 47 |

| 2028 | 0.52382461761825 | 0.3688905757875 | 0.2803568375985 | 57 |

| 2029 | 0.589192027647795 | 0.446357596702875 | 0.232105950285495 | 90 |

| 2030 | 0.730062485167222 | 0.517774812175335 | 0.419397597862021 | 120 |

IV. Investment Strategy Comparison: WNXM vs MANA

Long-term vs Short-term Investment Strategies

- WNXM: Suitable for investors focused on DeFi insurance potential and ecosystem growth

- MANA: Suitable for investors interested in metaverse development and virtual economy expansion

Risk Management and Asset Allocation

- Conservative investors: WNXM: 30% vs MANA: 70%

- Aggressive investors: WNXM: 60% vs MANA: 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- WNXM: Dependency on DeFi insurance adoption, market volatility

- MANA: Metaverse hype fluctuations, competition from other virtual world projects

Technical Risks

- WNXM: Scalability, network stability of Ethereum

- MANA: Platform security, user adoption challenges

Regulatory Risks

- Global regulatory policies may impact both tokens differently, with potential scrutiny on DeFi insurance and virtual asset regulations

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- WNXM advantages: Niche market in DeFi insurance, limited supply

- MANA advantages: Established metaverse platform, broader market appeal

✅ Investment Advice:

- New investors: Consider a balanced approach with a slight preference for MANA due to its more established market presence

- Experienced investors: Explore a higher allocation to WNXM for potential growth in the DeFi insurance sector

- Institutional investors: Diversify between both assets, with a focus on MANA for its larger market cap and liquidity

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between WNXM and MANA? A: WNXM is focused on decentralized insurance in the DeFi sector, while MANA is centered on the metaverse and virtual world economy. WNXM has a limited supply and represents a niche market, whereas MANA has a larger market cap and broader adoption in the gaming and virtual reality space.

Q2: Which token has shown better price performance historically? A: Both tokens have shown significant volatility. WNXM reached its all-time high of $130.82 in May 2021, while MANA hit $5.85 in November 2021. As of the current date (2025-10-24), WNXM is priced at $90.4, and MANA at $0.2349, indicating different recovery patterns from their respective highs.

Q3: How do the market capitalizations of WNXM and MANA compare? A: MANA has a significantly larger market capitalization at $450,809,682 compared to WNXM's $45,328,206. This suggests that MANA has a higher overall valuation and potentially greater liquidity in the market.

Q4: What are the key investment considerations for each token? A: For WNXM, consider its growth potential in the DeFi insurance sector and limited supply. For MANA, focus on the expanding metaverse adoption and potential partnerships in the virtual world space. Both face risks such as market volatility and regulatory challenges.

Q5: How should investors approach allocating between WNXM and MANA? A: Conservative investors might consider allocating 30% to WNXM and 70% to MANA, while aggressive investors might opt for 60% WNXM and 40% MANA. It's important to diversify and align the allocation with individual risk tolerance and investment goals.

Q6: What are the long-term price predictions for WNXM and MANA? A: By 2030, WNXM is predicted to reach a base scenario of $161.24 - $185.34, with an optimistic scenario of $185.34 - $272.44. MANA's base scenario for 2030 is $0.419 - $0.518, with an optimistic scenario of $0.518 - $0.730. However, these predictions are speculative and subject to market conditions.

Q7: Which token might be more suitable for new investors? A: New investors might find MANA more suitable due to its more established market presence and broader appeal in the metaverse space. However, a balanced approach considering both tokens could be beneficial, depending on individual risk tolerance and investment strategy.

Share

Content