RECALL vs ETH: Comparing the Performance and Potential of Two Blockchain Technologies

Introduction: RECALL vs ETH Investment Comparison

In the cryptocurrency market, the comparison between RECALL and ETH has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in crypto assets.

RECALL (RECALL): Since its launch, it has gained market recognition for its decentralized AI skill marketplace.

Ethereum (ETH): Since 2015, it has been hailed as the foundation for decentralized applications and smart contracts, and is one of the cryptocurrencies with the highest global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between RECALL and ETH, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

RECALL and ETH Historical Price Trends

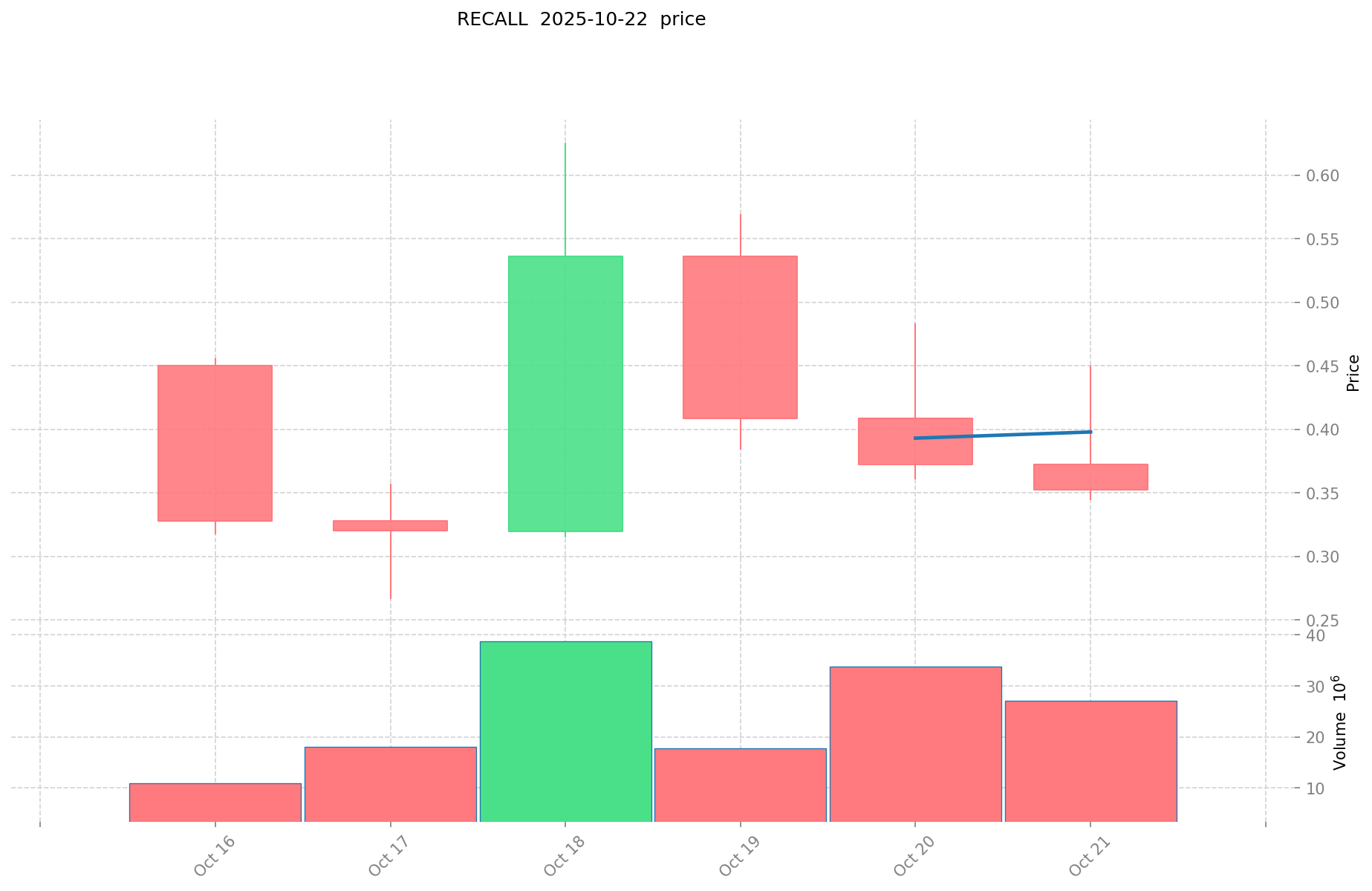

- 2025: RECALL experienced significant price fluctuations due to its recent launch and market volatility.

- 2025: ETH was influenced by continued adoption and ecosystem growth, showing price stability with moderate gains.

- Comparative Analysis: In the current market cycle, RECALL has shown high volatility, ranging from $0.2667 to $0.6255, while ETH has demonstrated more stability, maintaining a strong position as the second-largest cryptocurrency by market cap.

Current Market Situation (2025-10-22)

- RECALL current price: $0.3474

- ETH current price: $3873.4

- 24-hour trading volume: RECALL $10,451,650 vs ETH $916,023,184

- Market Sentiment Index (Fear & Greed Index): 34 (Fear)

Click to view real-time prices:

- View RECALL current price Market Price

- View ETH current price Market Price

Investment Value Analysis: RECALL vs ETH

Core Value Factors for RECALL vs ETH Investment

Supply Mechanism Comparison (Tokenomics)

- RECALL: Limited information available about the token's supply mechanism

- ETH: Deflationary model after the EIP-1559 implementation, with ETH being burned during transactions

- 📌 Historical pattern: Supply mechanisms drive price cycle changes, with ETH's burning mechanism potentially creating upward price pressure over time.

Institutional Adoption and Market Applications

- Institutional holdings: ETH appears more favored by institutions with significant trading volume and market presence

- Enterprise adoption: ETH has widespread use in DeFi, payments, and settlements; RECALL adoption details are limited

- Regulatory attitudes: Varied global regulatory approaches, with the SEC showing increasing interest in crypto regulation frameworks

Technological Development and Ecosystem Building

- ETH technical upgrades: Pectra upgrade (expected 2025) will implement Account Abstraction, improve Layer 2 scaling, lower gas fees, and increase staking limit from 32 to 2048 ETH

- RECALL technical development: Limited information available in the source materials

- Ecosystem comparison: ETH has a robust ecosystem including DeFi protocols (like the recently launched Tydro on Ink L2), NFTs, and smart contract applications

Macroeconomic Factors and Market Cycles

- Performance in inflationary environments: ETH has shown resilience during periods of inflation

- Macroeconomic monetary policy: Interest rates and USD index influence both assets, with ETH showing sensitivity to broader market conditions

- Geopolitical factors: Cross-border transaction demands impact both assets, with ETH's established network providing broader global utility

III. 2025-2030 Price Prediction: RECALL vs ETH

Short-term Prediction (2025)

- RECALL: Conservative $0.229 - $0.343 | Optimistic $0.343 - $0.377

- ETH: Conservative $2053.86 - $3875.21 | Optimistic $3875.21 - $4960.27

Mid-term Prediction (2027)

- RECALL may enter a growth phase, with projected prices of $0.300 - $0.468

- ETH may enter a bullish market, with projected prices of $3626.08 - $6748.54

- Key drivers: Institutional inflows, ETF approvals, ecosystem development

Long-term Prediction (2030)

- RECALL: Base scenario $0.392 - $0.594 | Optimistic scenario $0.594 - $0.886

- ETH: Base scenario $5903.58 - $7379.47 | Optimistic scenario $7379.47 - $9298.13

Disclaimer: These predictions are based on historical data and market analysis. Cryptocurrency markets are highly volatile and subject to change. This information should not be considered as financial advice.

RECALL:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.37675 | 0.3425 | 0.229475 | -1 |

| 2026 | 0.42076125 | 0.359625 | 0.34524 | 3 |

| 2027 | 0.46823175 | 0.390193125 | 0.30044870625 | 12 |

| 2028 | 0.61806591 | 0.4292124375 | 0.236066840625 | 23 |

| 2029 | 0.6650217506625 | 0.52363917375 | 0.429384122475 | 50 |

| 2030 | 0.885552388687312 | 0.59433046220625 | 0.392258105056125 | 71 |

ETH:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4960.2688 | 3875.21 | 2053.8613 | 0 |

| 2026 | 5654.706432 | 4417.7394 | 3224.949762 | 14 |

| 2027 | 6748.53870744 | 5036.222916 | 3626.08049952 | 30 |

| 2028 | 6776.237933478 | 5892.38081172 | 4772.8284574932 | 52 |

| 2029 | 8424.63146555667 | 6334.309372599 | 5004.10440435321 | 63 |

| 2030 | 9298.1327280380721 | 7379.470419077835 | 5903.576335262268 | 90 |

IV. Investment Strategy Comparison: RECALL vs ETH

Long-term vs Short-term Investment Strategy

- RECALL: Suitable for investors focused on AI marketplace potential and high-risk, high-reward opportunities

- ETH: Suitable for investors seeking stability, ecosystem growth, and potential inflation hedge

Risk Management and Asset Allocation

- Conservative investors: RECALL: 10% vs ETH: 90%

- Aggressive investors: RECALL: 30% vs ETH: 70%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- RECALL: High volatility due to recent launch and smaller market cap

- ETH: Susceptible to broader crypto market trends and macroeconomic factors

Technical Risk

- RECALL: Scalability, network stability (limited information available)

- ETH: Network congestion, smart contract vulnerabilities

Regulatory Risk

- Global regulatory policies may impact both, with ETH potentially facing more scrutiny due to its larger market presence

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- RECALL advantages: Potential for high growth, exposure to AI marketplace sector

- ETH advantages: Established ecosystem, deflationary model, institutional adoption

✅ Investment Advice:

- Novice investors: Consider a small allocation to RECALL, larger allocation to ETH for stability

- Experienced investors: Balanced approach with higher risk tolerance for RECALL

- Institutional investors: Focus on ETH for liquidity and market depth, monitor RECALL for potential opportunities

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between RECALL and ETH? A: RECALL is a newer cryptocurrency focused on decentralized AI skill marketplaces, while ETH is an established platform for decentralized applications and smart contracts. ETH has a larger market cap, higher trading volume, and a more developed ecosystem.

Q2: Which cryptocurrency has shown better price performance recently? A: Based on the provided information, ETH has demonstrated more price stability and moderate gains, while RECALL has experienced significant price fluctuations due to its recent launch and market volatility.

Q3: How do the supply mechanisms of RECALL and ETH compare? A: Limited information is available about RECALL's supply mechanism. ETH follows a deflationary model after the EIP-1559 implementation, with ETH being burned during transactions, potentially creating upward price pressure over time.

Q4: What are the key factors driving institutional adoption for these cryptocurrencies? A: ETH appears more favored by institutions due to its significant trading volume, market presence, and widespread use in DeFi, payments, and settlements. Information on RECALL's institutional adoption is limited in the provided context.

Q5: How do the long-term price predictions for RECALL and ETH compare? A: For 2030, RECALL's base scenario predicts $0.392 - $0.594, with an optimistic scenario of $0.594 - $0.886. ETH's base scenario for 2030 is $5903.58 - $7379.47, with an optimistic scenario of $7379.47 - $9298.13.

Q6: What are the main risks associated with investing in RECALL and ETH? A: RECALL faces high volatility due to its recent launch and smaller market cap. ETH is susceptible to broader crypto market trends and macroeconomic factors. Both face regulatory risks, with ETH potentially facing more scrutiny due to its larger market presence.

Q7: How should investors approach allocating their portfolio between RECALL and ETH? A: Conservative investors might consider allocating 10% to RECALL and 90% to ETH, while aggressive investors might opt for 30% RECALL and 70% ETH. Novice investors are advised to have a larger allocation to ETH for stability, while experienced investors might take a more balanced approach with higher risk tolerance for RECALL.

Share

Content