2Z vs GRT: The Battle for Dominance in the Emerging Tech Market

Introduction: Investment Comparison between 2Z and GRT

In the cryptocurrency market, the comparison between DoubleZero (2Z) vs The Graph (GRT) has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance but also represent different positions in crypto assets.

DoubleZero (2Z): Since its launch, it has gained market recognition for its decentralized framework for creating and managing high-performance decentralized networks.

The Graph (GRT): Introduced in 2020, it has been hailed as a decentralized protocol for indexing and querying blockchain data, primarily applied to Ethereum.

This article will provide a comprehensive analysis of the investment value comparison between 2Z and GRT, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question most crucial to investors:

"Which is the better buy right now?"

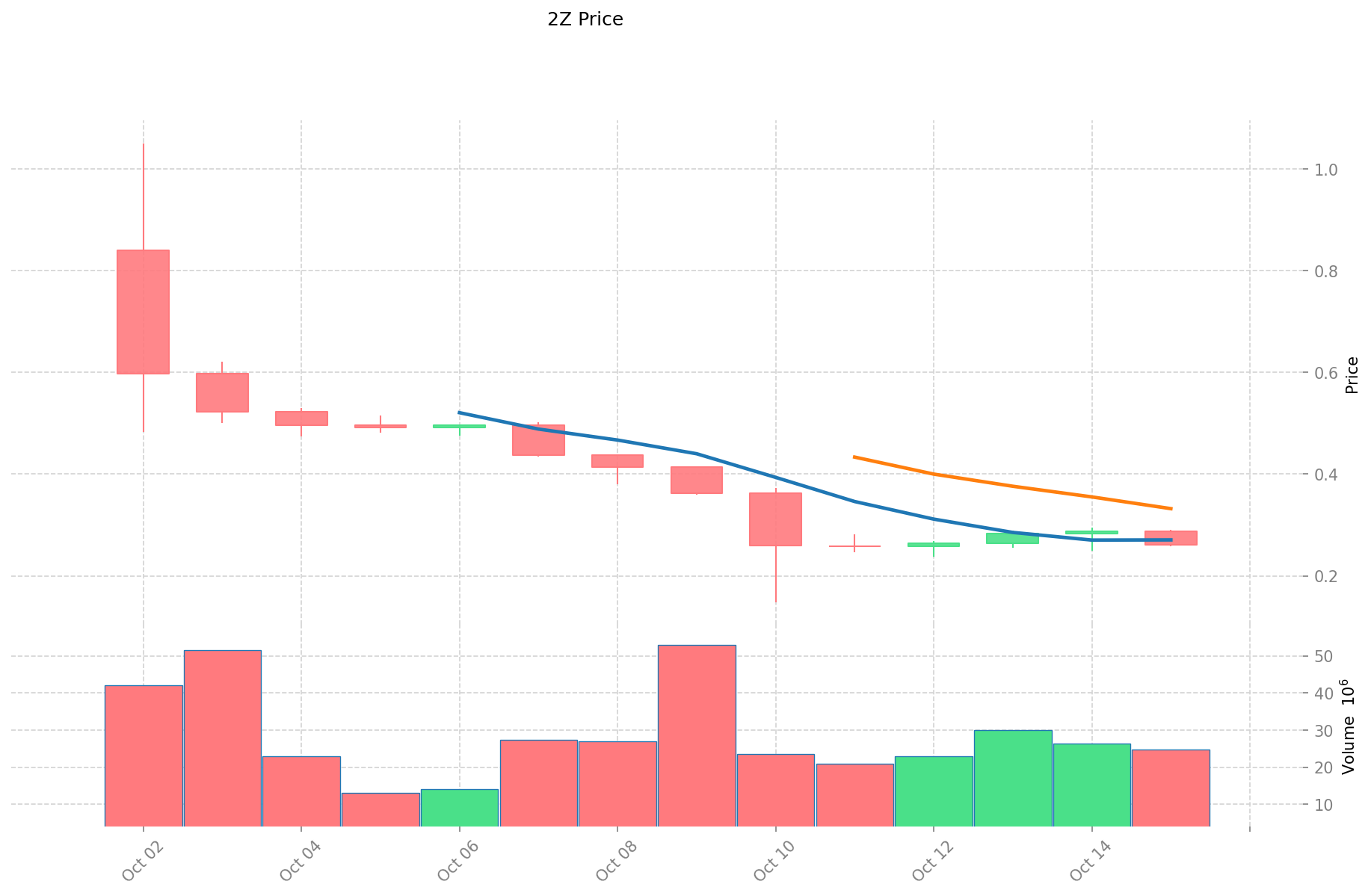

I. Price History Comparison and Current Market Status

DoubleZero (2Z) and The Graph (GRT) Historical Price Trends

- 2025: DoubleZero (2Z) reached its all-time high of $1.05 on October 2, then dropped to its all-time low of $0.14848 on October 10.

- 2025: The Graph (GRT) experienced significant volatility, with its price dropping from $0.17 to $0.06657 over the course of the year.

- Comparative Analysis: In this market cycle, 2Z fell from $1.05 to $0.2595, while GRT declined from $0.17 to $0.06657, showing both tokens have faced substantial losses.

Current Market Situation (2025-10-16)

- DoubleZero (2Z) current price: $0.2595

- The Graph (GRT) current price: $0.06657

- 24-hour trading volume: $6,588,054.93 (2Z) vs $367,781.06 (GRT)

- Market Sentiment Index (Fear & Greed Index): 28 (Fear)

Click to view real-time prices:

- View 2Z current price Market Price

- View GRT current price Market Price

Investment Value Analysis: 2Z vs GRT

I. Core Factors Affecting the Investment Value of 2Z vs GRT

Supply Mechanism Comparison (Tokenomics)

- GRT: The Graph uses an inflationary model with controlled token release to incentivize network participants

- 📌 Historical Pattern: Supply mechanisms tend to create price cycles around token release events and network upgrades.

Institutional Adoption and Market Applications

- Institutional Holdings: The Graph (GRT) has gained recognition for its data indexing capabilities in the blockchain space

- Enterprise Adoption: GRT has established use cases in decentralized data querying and indexing for blockchain applications

- Regulatory Attitudes: Different jurisdictions are gradually developing frameworks for data-oriented blockchain protocols

Technical Development and Ecosystem Building

- GRT Technical Development: The Graph protocol continues to enhance its query capabilities and expand supported networks

- Ecosystem Comparison: GRT has established itself as essential infrastructure for many DeFi applications requiring efficient data access

Macroeconomic Factors and Market Cycles

- Performance in Inflationary Environments: Data infrastructure tokens like GRT may show resilience during specific market conditions

- Macro Monetary Policy: Interest rates and dollar strength impact overall crypto market sentiment, affecting both assets

- Geopolitical Factors: Increased demand for decentralized data solutions could benefit protocols like The Graph in uncertain conditions

III. 2025-2030 Price Prediction: 2Z vs GRT

Short-term Prediction (2025)

- 2Z: Conservative $0.23-$0.26 | Optimistic $0.26-$0.29

- GRT: Conservative $0.05-$0.07 | Optimistic $0.07-$0.08

Mid-term Prediction (2027)

- 2Z may enter a growth phase, with prices expected in the range of $0.23-$0.41

- GRT may enter a growth phase, with prices expected in the range of $0.05-$0.12

- Key drivers: Institutional capital inflow, ETFs, ecosystem development

Long-term Prediction (2030)

- 2Z: Base scenario $0.35-$0.55 | Optimistic scenario $0.55-$0.67

- GRT: Base scenario $0.10-$0.12 | Optimistic scenario $0.12-$0.15

Disclaimer

2Z:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.2895312 | 0.25851 | 0.232659 | 0 |

| 2026 | 0.380888634 | 0.2740206 | 0.172632978 | 5 |

| 2027 | 0.41259281742 | 0.327454617 | 0.23249277807 | 26 |

| 2028 | 0.5476351014708 | 0.37002371721 | 0.1961125701213 | 42 |

| 2029 | 0.633184584889752 | 0.4588294093404 | 0.279885939697644 | 76 |

| 2030 | 0.666128536480392 | 0.546006997115076 | 0.349444478153648 | 110 |

GRT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0815244 | 0.06628 | 0.0483844 | 0 |

| 2026 | 0.100506992 | 0.0739022 | 0.039907188 | 11 |

| 2027 | 0.1177262046 | 0.087204596 | 0.04621843588 | 30 |

| 2028 | 0.119884518351 | 0.1024654003 | 0.09221886027 | 53 |

| 2029 | 0.136745199970365 | 0.1111749593255 | 0.10450446176597 | 67 |

| 2030 | 0.151231297170477 | 0.123960079647932 | 0.100407664514825 | 86 |

IV. Investment Strategy Comparison: 2Z vs GRT

Long-term vs Short-term Investment Strategies

- 2Z: Suitable for investors focusing on decentralized network performance and potential ecosystem growth

- GRT: Suitable for investors interested in blockchain data indexing and querying infrastructure

Risk Management and Asset Allocation

- Conservative investors: 2Z: 30% vs GRT: 70%

- Aggressive investors: 2Z: 60% vs GRT: 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- 2Z: Higher volatility due to lower market cap and trading volume

- GRT: Susceptible to overall crypto market trends and sentiment

Technical Risk

- 2Z: Scalability, network stability

- GRT: Query efficiency, data accuracy

Regulatory Risk

- Global regulatory policies may have different impacts on both tokens, particularly concerning data management and decentralized networks

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- 2Z advantages: Higher potential for growth, decentralized network performance

- GRT advantages: Established ecosystem, essential infrastructure for blockchain data indexing

✅ Investment Advice:

- New investors: Consider a balanced approach with a slight bias towards GRT for its established use cases

- Experienced investors: Explore opportunities in both tokens, adjusting allocation based on risk tolerance

- Institutional investors: Evaluate GRT for its potential as blockchain data infrastructure, while monitoring 2Z's development

⚠️ Risk Warning: The cryptocurrency market is highly volatile, and this article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between 2Z and GRT? A: 2Z focuses on creating and managing high-performance decentralized networks, while GRT is a protocol for indexing and querying blockchain data, primarily applied to Ethereum. GRT has a more established ecosystem and is widely used in DeFi applications, while 2Z has potential for growth in decentralized network performance.

Q2: Which token has shown better price performance recently? A: Based on the provided data, 2Z has shown better recent price performance. As of October 16, 2025, 2Z is priced at $0.2595, while GRT is at $0.06657. However, both tokens have experienced significant losses in the current market cycle.

Q3: How do the supply mechanisms differ between 2Z and GRT? A: GRT uses an inflationary model with controlled token release to incentivize network participants. The supply mechanism for 2Z is not explicitly stated in the given information.

Q4: What are the key factors affecting the investment value of these tokens? A: Key factors include supply mechanisms, institutional adoption, market applications, technical development, ecosystem building, macroeconomic factors, and market cycles. Additionally, regulatory attitudes and geopolitical factors can impact their value.

Q5: What are the predicted price ranges for 2Z and GRT in 2030? A: For 2Z, the base scenario predicts $0.35-$0.55, with an optimistic scenario of $0.55-$0.67. For GRT, the base scenario predicts $0.10-$0.12, with an optimistic scenario of $0.12-$0.15.

Q6: How should investors approach risk management when investing in 2Z and GRT? A: Conservative investors might consider allocating 30% to 2Z and 70% to GRT, while aggressive investors might allocate 60% to 2Z and 40% to GRT. Hedging tools such as stablecoin allocation, options, and cross-currency portfolios can also be used to manage risk.

Q7: What are the main risks associated with investing in 2Z and GRT? A: The main risks include market risk (volatility and overall crypto market trends), technical risk (scalability, network stability, query efficiency, data accuracy), and regulatory risk (potential impacts of global regulatory policies on data management and decentralized networks).

Q8: Which token might be more suitable for different types of investors? A: New investors might consider a balanced approach with a slight bias towards GRT for its established use cases. Experienced investors could explore opportunities in both tokens, adjusting allocation based on risk tolerance. Institutional investors may evaluate GRT for its potential as blockchain data infrastructure while monitoring 2Z's development.

Share

Content