2025 SHX Price Prediction: Bullish Trends and Market Factors Driving Potential Growth

Introduction: SHX's Market Position and Investment Value

Stronghold (SHX), as a pioneering force in innovative payment and financial service solutions, has made significant strides since its inception. As of 2025, Stronghold's market capitalization has reached $68,681,096, with a circulating supply of approximately 5,374,948,822 tokens, and a price hovering around $0.012778. This asset, hailed as a "Forbes Fintech 50" company, is playing an increasingly crucial role in improving financial access through its open API platform.

This article will comprehensively analyze Stronghold's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic conditions to provide investors with professional price predictions and practical investment strategies.

I. SHX Price History Review and Current Market Status

SHX Historical Price Evolution

- 2021: All-time high of $0.055673 reached on May 17, marking a significant milestone

- 2021: All-time low of $0.000000130103 recorded on April 7, showing extreme volatility

- 2025: Current price at $0.012778, reflecting a 219.41% increase over the past year

SHX Current Market Situation

As of October 22, 2025, SHX is trading at $0.012778, with a market capitalization of $68,681,096. The token has experienced mixed performance across different timeframes. In the past 24 hours, SHX has seen a slight decline of 0.97%. However, it has shown positive momentum in the short term, with a 0.91% increase in the last hour and a 2.51% gain over the past week. Despite these recent gains, SHX has faced significant downward pressure in the medium term, with a 30.86% decrease over the last 30 days. The long-term performance remains strong, as evidenced by the 219.41% increase over the past year. The token's circulating supply stands at 5,374,948,822.95804 SHX, which represents 5.37% of the total supply of 99,756,866,344 SHX. The fully diluted market cap is $1,277,800,000, indicating potential for growth if the entire supply were to be circulated.

Click to view the current SHX market price

SHX Market Sentiment Indicator

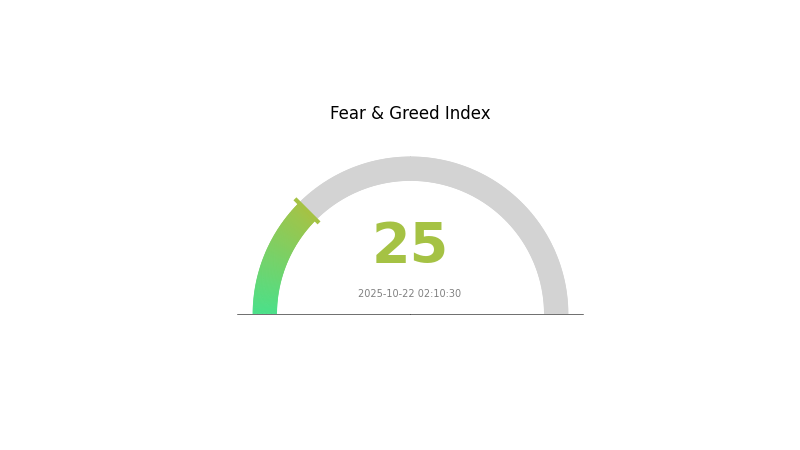

2025-10-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment index plummeting to 25. This level of pessimism often precedes potential buying opportunities, as assets may be undervalued. However, caution is advised as market volatility could persist. Savvy investors might consider dollar-cost averaging strategies to mitigate risks while potentially capitalizing on discounted prices. Remember, market cycles are natural, and this fear phase could be temporary. Stay informed and make decisions based on thorough research and your risk tolerance.

SHX Holdings Distribution

The address holdings distribution data for SHX reveals an interesting pattern in the token's ownership structure. While the provided table is empty, this absence of concentrated holdings among top addresses suggests a potentially wide distribution of SHX tokens across the network.

This lack of large individual holders could indicate a relatively decentralized ownership structure for SHX. Such a distribution may contribute to reduced market manipulation risks and potentially more stable price movements, as no single entity appears to hold a disproportionate amount of tokens that could significantly impact the market.

However, it's important to note that this distribution pattern may also reflect a young or developing ecosystem. The absence of major holders could indicate that SHX is still in its early stages of adoption and distribution among users and investors. As the project matures, we may see a more defined ownership structure emerge.

Click to view the current SHX holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting Future SHX Price

Supply Mechanism

- Liquidity management: The level of liquidity management impacts SHX price

- Historical patterns: Changes in liquidity have affected price in the past

- Current impact: Expected effects of current liquidity changes on price

Institutional and Large Holder Dynamics

- Institutional holdings: Major institutions' SHX holdings situation

- Corporate adoption: Notable companies adopting SHX

- National policies: Relevant policies at the national level

Macroeconomic Environment

- Monetary policy impact: Expected policies of major central banks

- Inflation hedge properties: Performance in inflationary environments

- Geopolitical factors: Impacts of international situations

III. SHX Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.01176 - $0.01279

- Neutral forecast: $0.01279 - $0.01515

- Optimistic forecast: $0.01515 - $0.01752 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.0112 - $0.01942

- 2028: $0.01385 - $0.01957

- Key catalysts: Increasing adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.01902 - $0.02025 (assuming steady market growth)

- Optimistic scenario: $0.02025 - $0.02754 (assuming favorable market conditions)

- Transformative scenario: $0.02754+ (assuming exceptional market performance and widespread adoption)

- 2030-12-31: SHX $0.02754 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01752 | 0.01279 | 0.01176 | 0 |

| 2026 | 0.01985 | 0.01515 | 0.00788 | 18 |

| 2027 | 0.01942 | 0.0175 | 0.0112 | 36 |

| 2028 | 0.01957 | 0.01846 | 0.01385 | 44 |

| 2029 | 0.02149 | 0.01902 | 0.01426 | 48 |

| 2030 | 0.02754 | 0.02025 | 0.01478 | 58 |

IV. Professional Investment Strategies and Risk Management for SHX

SHX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with a high risk tolerance

- Operation suggestions:

- Accumulate SHX during market dips

- Set price alerts for significant price movements

- Store in a secure wallet with regular backups

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key points for swing trading:

- Monitor trading volume for potential breakouts

- Use stop-loss orders to manage risk

SHX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for SHX

SHX Market Risks

- Volatility: Significant price fluctuations common in the crypto market

- Liquidity: Limited trading volume may impact ability to enter/exit positions

- Competition: Other fintech projects may compete for market share

SHX Regulatory Risks

- Regulatory uncertainty: Changing regulations may impact SHX's operations

- Compliance costs: Potential increased costs to meet regulatory requirements

- Geographic restrictions: Possible limitations in certain jurisdictions

SHX Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: Possible transaction delays during high network activity

- Technological obsolescence: Risk of being outpaced by newer technologies

VI. Conclusion and Action Recommendations

SHX Investment Value Assessment

SHX presents a unique investment opportunity in the fintech space, with potential for long-term growth. However, investors should be aware of the high volatility and regulatory uncertainties in the short term.

SHX Investment Recommendations

✅ Beginners: Start with small, regular investments to learn about market dynamics ✅ Experienced investors: Consider a balanced approach with both long-term holdings and active trading ✅ Institutional investors: Conduct thorough due diligence and consider SHX as part of a diversified crypto portfolio

SHX Trading Participation Methods

- Spot trading: Buy and sell SHX directly on Gate.com

- Limit orders: Set specific buy or sell prices to automate trades

- Dollar-cost averaging: Regular, fixed-amount purchases to mitigate market volatility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does SHx have a future?

Yes, SHx has a promising future. With strong leadership and a dedicated team, SHx shows great potential for growth and development in the crypto market.

Would hamster kombat coin reach $1?

It's possible for Hamster Kombat to reach $1, given its growing popularity and play-to-earn model. Like other meme coins, its future depends on market trends and investor interest.

What will Hex be worth in 2025?

Based on current trends, Hex could reach $115,594.8 in 2025, but it might also drop to $0.004094. Crypto markets are highly volatile.

Will hamster coin prices increase?

Yes, hamster coin prices are expected to increase. Forecasts suggest a 12.98% rise, reaching $0.0030799 by November 14, 2025.

Share

Content