2025 OG Price Prediction: Analyzing Market Trends and Potential Growth Factors for Origin Protocol

Introduction: OG's Market Position and Investment Value

OG Fan Token (OG), as a fan engagement token for the OG esports team, has been making waves in the crypto and esports industries since its inception. As of 2025, OG's market capitalization has reached $78,891,357, with a circulating supply of approximately 4,369,986 tokens, and a price hovering around $18.053. This asset, often referred to as the "esports governance token," is playing an increasingly crucial role in fan participation and team decision-making processes.

This article will comprehensively analyze OG's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. OG Price History Review and Current Market Status

OG Historical Price Evolution

- 2022: OG reached its all-time low of $1.18 on May 12

- 2025: OG hit its all-time high of $24.78 on September 11

- 2025: Price has stabilized around $18 in October

OG Current Market Situation

As of October 21, 2025, OG is trading at $18.053, with a 24-hour trading volume of $237,489.92. The token has shown positive momentum across various timeframes, with a 1.47% increase in the past 24 hours and a more significant 9.54% gain over the last 30 days. The most impressive growth is observed in the yearly performance, with OG surging by 160.49% compared to its price one year ago.

OG's market capitalization currently stands at $78,891,357, ranking it 473rd among all cryptocurrencies. The token has a circulating supply of 4,369,986 OG out of a total supply of 5,000,000 OG, resulting in a circulation ratio of 87.39972%.

The current price of $18.053 is closer to its all-time high than its all-time low, suggesting a generally bullish long-term trend. However, the market sentiment indicator shows a "Fear" reading of 34, indicating some caution among investors despite the positive price action.

Click to view the current OG market price

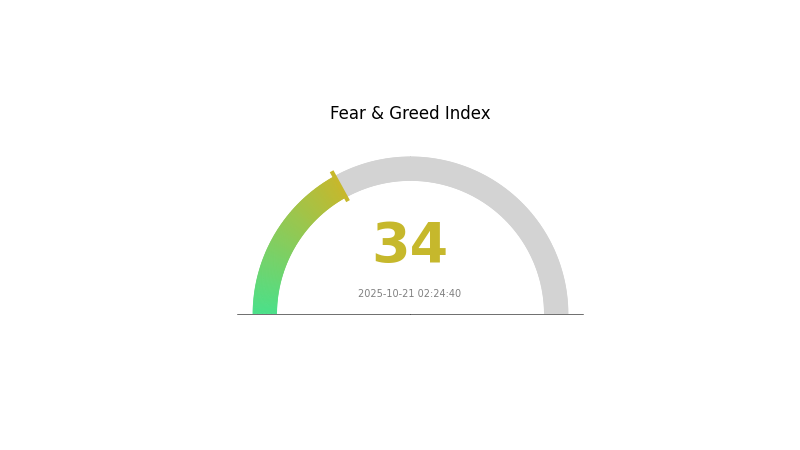

OG Market Sentiment Indicator

2025-10-21 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, with the sentiment index at 34. This indicates a cautious approach among investors, potentially due to recent market uncertainties or regulatory concerns. During such times, seasoned traders often see opportunities for strategic buys, adhering to the adage "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and exercise prudence in investment decisions, especially in volatile markets.

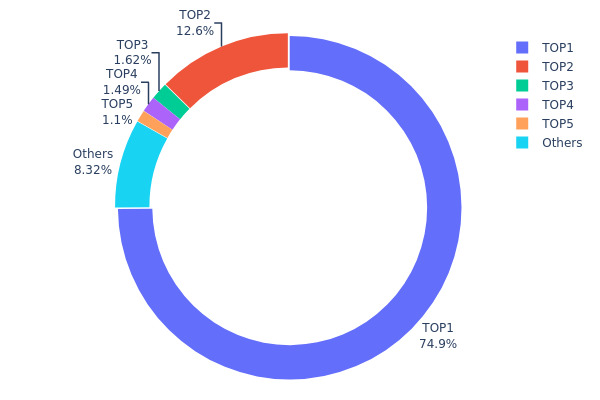

OG Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for OG tokens. The top address holds a significant 74.87% of the total supply, while the second-largest holder accounts for 12.60%. This concentration is further emphasized by the fact that the top five addresses collectively control 91.68% of all OG tokens.

Such a concentrated distribution raises concerns about market manipulation and price volatility. With a single address controlling nearly three-quarters of the supply, there's a potential for large-scale market movements if this holder decides to sell or transfer their tokens. This concentration also implies a low level of decentralization, which could impact the token's governance and overall market stability.

The current distribution structure suggests that OG's market is susceptible to significant price swings and may be vulnerable to whale activity. Investors should be aware that this concentration could lead to increased volatility and potential liquidity issues in the short to medium term.

Click to view the current OG Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xF977...41aceC | 3743.63K | 74.87% |

| 2 | 0x6F45...41a33D | 630.01K | 12.60% |

| 3 | 0x8791...988062 | 80.92K | 1.62% |

| 4 | 0x0D07...b492Fe | 74.37K | 1.49% |

| 5 | 0x5bdf...03F7Ef | 54.93K | 1.10% |

| - | Others | 416.14K | 8.32% |

II. Key Factors Affecting Future OG Prices

Supply Mechanism

- Oil Production: Future international oil prices are unlikely to see sustained significant increases due to diversification in energy markets and geopolitical factors.

Macroeconomic Environment

- Monetary Policy Impact: The market has strong expectations for interest rate cuts by the Federal Reserve.

- Inflation Hedging Properties: Gold prices have shown resilience despite rising real yields, indicating its potential as an inflation hedge.

- Geopolitical Factors: Ongoing geopolitical uncertainties drive safe-haven demand for gold.

Technical Development and Ecosystem Building

- Industrial Recovery: Oil prices are expected to rise slightly, driven by further recovery in European and American industries and the international shipping market.

III. OG Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $11.36 - $18.04

- Neutral prediction: $18.04 - $24.54

- Optimistic prediction: $24.54 - $25.34 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential bull market phase

- Price range forecast:

- 2027: $13.52 - $33.81

- 2028: $26.85 - $34.84

- Key catalysts: Increased adoption, technological advancements, and overall crypto market growth

2030 Long-term Outlook

- Base scenario: $30.96 - $33.29 (assuming steady market growth)

- Optimistic scenario: $33.29 - $43.61 (assuming strong bullish trends)

- Transformative scenario: $43.61+ (assuming groundbreaking developments in the OG ecosystem)

- 2030-12-31: OG $33.29 (potential market stabilization point)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 24.53984 | 18.044 | 11.36772 | 0 |

| 2026 | 25.33738 | 21.29192 | 17.45937 | 18 |

| 2027 | 33.80625 | 23.31465 | 13.5225 | 29 |

| 2028 | 34.84375 | 28.56045 | 26.84682 | 58 |

| 2029 | 34.87231 | 31.7021 | 25.36168 | 75 |

| 2030 | 43.60624 | 33.2872 | 30.9571 | 84 |

IV. OG Professional Investment Strategies and Risk Management

OG Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Fans of OG esports team and long-term crypto investors

- Operation suggestions:

- Accumulate OG tokens during market dips

- Participate in governance decisions to increase engagement

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor OG team performance and upcoming events

- Track overall crypto market sentiment

OG Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple fan tokens and crypto assets

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for OG

OG Market Risks

- High volatility: Fan token prices can fluctuate dramatically

- Limited liquidity: May face challenges in large-scale buying or selling

- Dependency on team performance: Token value closely tied to OG esports team success

OG Regulatory Risks

- Uncertain regulatory landscape: Fan tokens may face increased scrutiny

- Potential classification changes: Risk of being categorized as securities

- Cross-border compliance issues: Varying regulations across jurisdictions

OG Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Blockchain network congestion: May affect transaction speed and costs

- wallet security breaches: Risk of theft or loss if proper security measures aren't taken

VI. Conclusion and Action Recommendations

OG Investment Value Assessment

OG Fan Token offers unique engagement opportunities for OG esports fans but carries significant risks due to its niche market and high volatility. Long-term value depends on the team's performance and the growth of fan token adoption.

OG Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about fan tokens and blockchain technology

✅ Experienced investors: Consider OG as part of a diversified crypto portfolio, engage in governance

✅ Institutional investors: Evaluate OG as part of a broader fan token or esports-related investment strategy

OG Trading Participation Methods

- Spot trading: Buy and sell OG tokens on Gate.com

- Staking: Participate in staking programs if available

- Governance participation: Use OG tokens to vote on team decisions through the Socios platform

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is 1 OG token?

As of October 21, 2025, 1 OG token is priced at $16.10. The token has seen a significant 253.20% increase in value over the past month.

Why is OG fan token pumping?

OG fan token is pumping due to coordinated buying by insiders, creating artificial demand. This often leads to price spikes, followed by sell-offs. Low liquidity amplifies these price movements.

Will DOGE hit $10?

Based on current trends, DOGE reaching $10 is unlikely. Analysts project a potential peak of $1.10 by 2025, but market conditions don't support a $10 valuation in the foreseeable future.

What will DOGE be worth in 2025?

Based on expert predictions, DOGE could be worth between $0.5710 and $0.6898 in 2025, with an average price of $0.1. However, cryptocurrency prices are highly volatile and subject to market conditions.

Share

Content