2025 MLK Price Prediction: Analyzing Market Trends and Future Prospects for Milk Tokens

Introduction: MLK's Market Position and Investment Value

MiL.k (MLK), as a blockchain-based point integration platform connecting various services in lifestyle, tourism, and leisure, has made significant strides since its inception. As of 2025, MLK's market cap has reached $52,412,446, with a circulating supply of approximately 504,645,159 tokens, and a price hovering around $0.10386. This asset, dubbed the "lifestyle rewards integrator," is playing an increasingly crucial role in revolutionizing loyalty programs and enhancing user experiences in daily life.

This article will comprehensively analyze MLK's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. MLK Price History Review and Current Market Status

MLK Historical Price Evolution Trajectory

- 2021: Reached all-time high, price peaked at $4.33902357 on April 3

- 2022: Global expansion began, price fluctuated

- 2025: Market downturn, price dropped to a low of $0.10089465963392259 on October 17

MLK Current Market Situation

As of October 23, 2025, MLK is trading at $0.10386, with a market cap of $52,412,446.21. The token has experienced a significant decline from its all-time high, currently down 97.61%. In the past 24 hours, MLK has seen a decrease of 2.35%, with the price ranging between $0.10327 and $0.10746. The trading volume in the last 24 hours stands at $23,963.28, indicating moderate market activity. The circulating supply is 504,645,159 MLK, which represents 51.17% of the total supply of 986,245,419 tokens. MLK's market dominance is relatively low at 0.0026%, suggesting it is a small-cap asset in the broader cryptocurrency market.

Click to view the current MLK market price

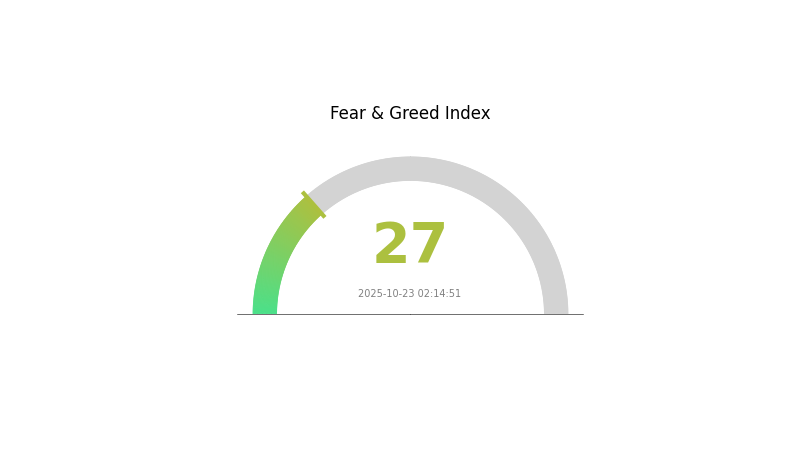

MLK Market Sentiment Indicator

2025-10-23 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 27, indicating a state of fear. This suggests investors are wary and potentially perceiving the market as overvalued. During such periods, some view it as an opportunity to buy, following the contrarian investment strategy. However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Keep an eye on market trends and stay informed about factors influencing crypto prices.

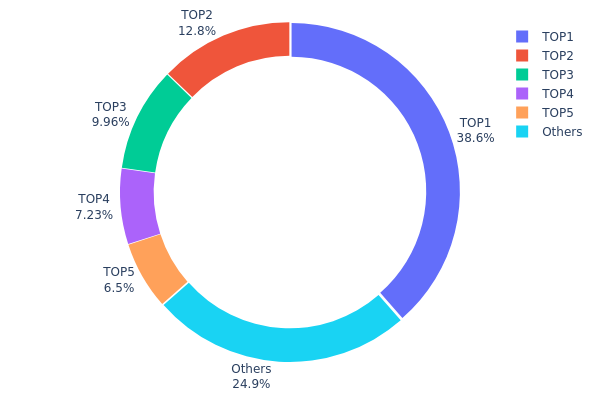

MLK Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of MLK tokens among various wallet addresses. Analysis of this data reveals a highly centralized distribution pattern for MLK. The top address holds a substantial 38.56% of the total supply, while the top five addresses collectively control 75.03% of all MLK tokens.

This concentration level raises concerns about market stability and potential price manipulation. With such a significant portion of tokens held by a few addresses, large-scale transactions could trigger substantial price volatility. Moreover, the high concentration in top addresses suggests a low level of decentralization, which may impact the project's governance and decision-making processes.

The current distribution structure indicates a relatively immature market for MLK, with limited circulation among a broader user base. This concentration could pose risks to market liquidity and may deter potential investors concerned about sudden large sell-offs. As the project develops, a more even distribution would be desirable to enhance market stability and foster a more robust ecosystem for MLK.

Click to view the current MLK Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb879...720f4d | 380315.97K | 38.56% |

| 2 | 0x7184...26af9f | 126281.25K | 12.80% |

| 3 | 0x46e4...07675a | 98218.75K | 9.95% |

| 4 | 0x68a0...3ea75b | 71281.25K | 7.22% |

| 5 | 0xc417...ffb833 | 64118.94K | 6.50% |

| - | Others | 246029.25K | 24.97% |

II. Key Factors Affecting MLK's Future Price

Macroeconomic Environment

- Monetary Policy Impact: Major central banks' policy expectations may influence MLK's price as they affect overall market liquidity and risk appetite.

- Geopolitical Factors: International situations and conflicts can impact MLK's value as a potential safe-haven asset during times of global uncertainty.

Technological Development and Ecosystem Building

- Ecosystem Applications: The development of major DApps and ecosystem projects on the MLK network could drive adoption and increase demand for the token.

III. MLK Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.07893 - $0.09000

- Neutral prediction: $0.09000 - $0.11000

- Optimistic prediction: $0.11000 - $0.12774 (requires favorable market conditions)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.06716 - $0.13779

- 2027: $0.08749 - $0.17117

- Key catalysts: Market adoption, technological advancements

2030 Long-term Outlook

- Base scenario: $0.11063 - $0.18438 (assuming steady market growth)

- Optimistic scenario: $0.18438 - $0.19176 (assuming strong market performance)

- Transformative scenario: Above $0.19176 (extreme favorable conditions)

- 2030-12-31: MLK $0.19176 (potential peak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.12774 | 0.10385 | 0.07893 | 0 |

| 2026 | 0.13779 | 0.11579 | 0.06716 | 11 |

| 2027 | 0.17117 | 0.12679 | 0.08749 | 22 |

| 2028 | 0.20559 | 0.14898 | 0.10578 | 43 |

| 2029 | 0.19147 | 0.17729 | 0.16488 | 70 |

| 2030 | 0.19176 | 0.18438 | 0.11063 | 77 |

IV. Professional Investment Strategies and Risk Management for MLK

MLK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operation suggestions:

- Accumulate MLK tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure cold wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor 50-day and 200-day MAs for trend identification

- Relative Strength Index (RSI): Use for overbought/oversold conditions

- Key points for swing trading:

- Identify support and resistance levels

- Monitor trading volume for trend confirmation

MLK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Plans

- Diversification: Spread investments across different cryptocurrencies and asset classes

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for MLK

MLK Market Risks

- High volatility: Significant price fluctuations common in the cryptocurrency market

- Liquidity risk: Potential difficulty in selling large amounts without affecting price

- Market sentiment: Susceptible to rapid changes based on news and social media

MLK Regulatory Risks

- Changing regulations: Potential for new laws affecting cryptocurrency usage and trading

- Cross-border restrictions: Varying legal status in different countries

- Tax implications: Evolving tax policies for cryptocurrency transactions

MLK Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: Possibility of transaction delays during high network activity

- Technological obsolescence: Risk of being outpaced by newer blockchain technologies

VI. Conclusion and Action Recommendations

MLK Investment Value Assessment

MLK shows potential as a utility token in the travel and lifestyle sectors, but faces significant short-term volatility and regulatory uncertainties. Long-term value proposition depends on the growth and adoption of the MiL.k ecosystem.

MLK Investment Recommendations

✅ Beginners: Start with small, regular investments to understand market dynamics ✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading ✅ Institutional investors: Conduct thorough due diligence and consider MLK as part of a diversified crypto portfolio

MLK Trading Participation Methods

- Spot trading: Direct purchase and sale of MLK tokens on Gate.com

- Staking: Participate in staking programs if available for passive income

- DeFi integration: Explore decentralized finance options using MLK tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Would hamster kombat coin reach $1?

Based on current predictions, Hamster Kombat coin has potential to reach $1 by 2028. Market trends and blockchain gaming adoption will be key factors in its growth.

What is the MKR prediction for 2025?

Based on market analysis, the MKR price prediction for 2025 ranges from a minimum of $3,718 to a maximum of $5,790.

Can Mina Protocol reach $100?

Reaching $100 is highly improbable for Mina Protocol. It would require a massive 94,000%+ gain, which is not supported by current market projections or fundamentals.

Is MKR a buy or sell?

MKR is currently a strong sell. Recent forecasts suggest selling MKR is advisable for the near future.

Share

Content