2025 MIRROR Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: MIRROR's Market Position and Investment Value

Black Mirror (MIRROR), as the official token of the Black Mirror ecosystem, has been empowering fans to shape dystopian experiences and engage in interactive storytelling since its inception. As of 2025, MIRROR's market capitalization stands at $2,212,261, with a circulating supply of approximately 187,004,374 tokens, and a price hovering around $0.01183. This asset, hailed as the "dystopian experience token," is playing an increasingly crucial role in bridging entertainment, Web3, and interactive storytelling.

This article will comprehensively analyze MIRROR's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. MIRROR Price History Review and Current Market Status

MIRROR Historical Price Evolution Trajectory

- 2025 September: MIRROR reached its all-time high of $0.08582, marking a significant milestone for the project

- 2025 October: The token experienced a sharp decline, with the price dropping to its all-time low of $0.01116

MIRROR Current Market Situation

As of October 15, 2025, MIRROR is trading at $0.01183, representing a 24-hour decrease of 5.19%. The token's market capitalization stands at $2,212,261, with a circulating supply of 187,004,374 MIRROR tokens. The fully diluted valuation of the project is $11,830,000.

MIRROR has seen significant volatility in recent periods:

- 1-hour change: +0.08%

- 7-day change: -33.82%

- 30-day change: -78.10%

The token is currently trading 86.22% below its all-time high, indicating a substantial correction from its peak price. The market sentiment for MIRROR appears bearish in the short term, with the token experiencing notable downward pressure across various timeframes.

Click to view the current MIRROR market price

MIRROR Market Sentiment Indicator

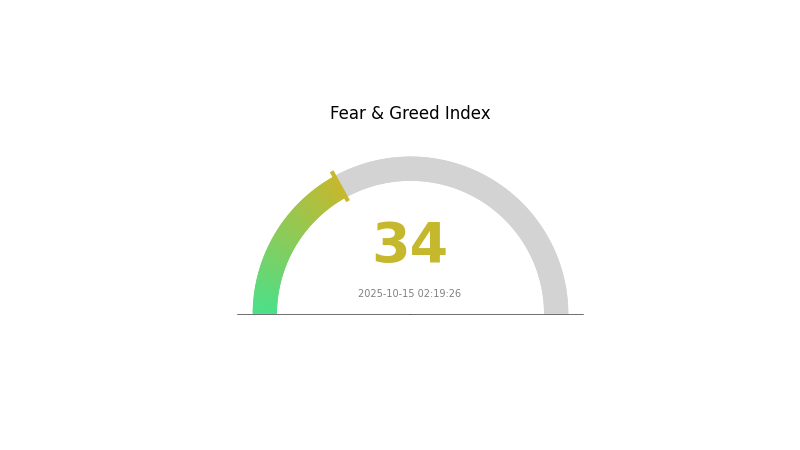

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, with the sentiment index at 34. This indicates a cautious atmosphere among investors. During such times, it's crucial to stay informed and make rational decisions. While fear may present buying opportunities for some, it's essential to conduct thorough research and manage risks carefully. Remember, market sentiment can shift quickly, so always stay updated with the latest trends and analyses.

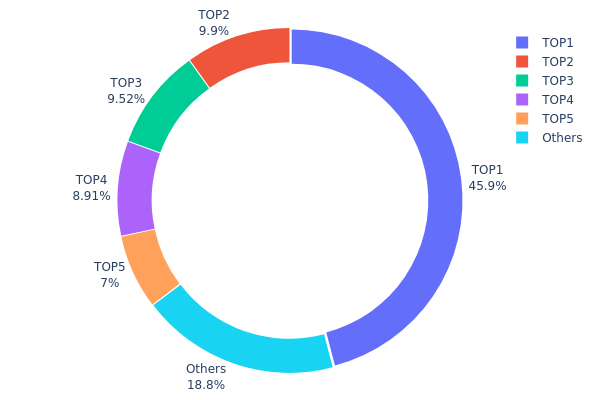

MIRROR Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for MIRROR. The top address holds a substantial 45.92% of the total supply, while the top 5 addresses collectively control 81.22% of all tokens. This level of concentration indicates a significant imbalance in token distribution.

Such a concentrated distribution pattern raises concerns about market stability and potential price manipulation. With nearly half of the supply controlled by a single entity, there's an increased risk of large-scale sell-offs or buy-ins that could dramatically impact MIRROR's price. Furthermore, the high concentration in a few wallets suggests limited decentralization, which may conflict with the project's stated goals or community expectations.

This distribution structure also implies that MIRROR's on-chain governance, if implemented, could be heavily influenced by a small number of large token holders. It's crucial for potential investors to consider these factors when assessing MIRROR's market dynamics and long-term prospects.

Click to view the current MIRROR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xcf0b...c806da | 459237.88K | 45.92% |

| 2 | 0x65fb...d6dd1b | 98999.99K | 9.89% |

| 3 | 0x452d...f9e645 | 95160.38K | 9.51% |

| 4 | 0x4fe0...8978df | 89099.57K | 8.90% |

| 5 | 0x1167...ec6992 | 70000.00K | 7.00% |

| - | Others | 187502.19K | 18.78% |

II. Key Factors Affecting MIRROR's Future Price

Supply Mechanism

- Raw Material Costs: The main cost component of MIRROR products is LCD panels. The selling price of finished products fluctuates with raw material prices. However, overall, the impact of decreased sales unit price on gross profit margin is less than the impact of cost reduction.

Institutional and Whale Dynamics

- Corporate Adoption: Notable companies adopting smart mirror technology may influence MIRROR's price.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve's interest rate decisions may cause short-term price volatility in related markets.

- Inflation Hedging Properties: In an inflationary environment, MIRROR's performance may be influenced by broader economic conditions.

- Geopolitical Factors: Global geopolitical and financial landscape restructuring could impact demand and prices.

Technical Development and Ecosystem Building

- Market Demand: Future price trends of MIRROR are influenced by market demand for smart mirror products.

- Technological Advancements: Ongoing innovations in smart mirror technology could affect MIRROR's value proposition and price.

- Ecosystem Applications: Development of main DApps or ecosystem projects related to MIRROR could impact its price and adoption.

III. MIRROR Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00864 - $0.01184

- Neutral forecast: $0.01184 - $0.01302

- Optimistic forecast: $0.01302 - $0.01421 (requires positive market sentiment)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.01226 - $0.01575

- 2028: $0.00935 - $0.01944

- Key catalysts: Increased adoption, technological improvements

2029-2030 Long-term Outlook

- Base scenario: $0.01714 - $0.01928 (assuming steady market growth)

- Optimistic scenario: $0.02143 - $0.02796 (assuming strong market performance)

- Transformative scenario: Above $0.02796 (exceptional market conditions and widespread adoption)

- 2030-12-31: MIRROR $0.01928 (potential 63% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01421 | 0.01184 | 0.00864 | 0 |

| 2026 | 0.01485 | 0.01302 | 0.0099 | 10 |

| 2027 | 0.01575 | 0.01394 | 0.01226 | 17 |

| 2028 | 0.01944 | 0.01484 | 0.00935 | 25 |

| 2029 | 0.02143 | 0.01714 | 0.01131 | 44 |

| 2030 | 0.02796 | 0.01928 | 0.01485 | 63 |

IV. Professional Investment Strategies and Risk Management for MIRROR

MIRROR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a passion for interactive entertainment and Web3

- Operational suggestions:

- Accumulate MIRROR tokens during market dips

- Participate actively in the Black Mirror ecosystem to maximize token utility

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Black Mirror project announcements and updates

- Track overall market sentiment in the entertainment and Web3 sectors

MIRROR Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple sectors within the crypto space

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 Wallet

- Cold storage option: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update security settings

V. Potential Risks and Challenges for MIRROR

MIRROR Market Risks

- High volatility: MIRROR may experience significant price swings

- Limited liquidity: Trading volume may be low, affecting entry and exit points

- Correlation with entertainment industry trends: Performance may be influenced by broader market sentiment

MIRROR Regulatory Risks

- Uncertain regulatory landscape: Potential for new regulations affecting tokenized entertainment projects

- Cross-border compliance issues: Varying regulations across different jurisdictions

- Intellectual property concerns: Potential legal challenges related to the use of Black Mirror IP

MIRROR Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the underlying code

- Scalability challenges: Possible limitations in handling increased user activity

- Interoperability issues: Potential difficulties in integrating with other blockchain networks or platforms

VI. Conclusion and Action Recommendations

MIRROR Investment Value Assessment

MIRROR presents a unique opportunity in the intersection of entertainment and blockchain technology. While it offers long-term potential for growth and innovation in interactive storytelling, investors should be aware of the high volatility and regulatory uncertainties in the short term.

MIRROR Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about the Black Mirror ecosystem ✅ Experienced investors: Consider a moderate allocation based on risk tolerance and belief in the project's vision ✅ Institutional investors: Conduct thorough due diligence and consider MIRROR as part of a diversified Web3 entertainment portfolio

MIRROR Trading Participation Methods

- Spot trading: Purchase MIRROR tokens on Gate.com

- Ecosystem participation: Engage with Black Mirror interactive experiences to earn rewards

- Staking: Explore any available staking options to earn passive income (if applicable)

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will mirror protocol recover?

Mirror Protocol's recovery is possible but uncertain. It depends on addressing security issues and market conditions. No definite timeline exists, but improvements could lead to a potential comeback.

What is the price prediction for the mirror protocol coin?

Mirror Protocol's price is predicted to reach $0.010446 by 2025, representing a 4.15% gain from current levels.

What crypto has the highest price prediction?

As of 2025, Ethereum has the highest price prediction among major cryptocurrencies, based on market trends and technological advancements.

What is the price prediction for XRP in 2025?

Based on current market trends and expert analysis, XRP is predicted to reach a price of $1.50 by 2025.

Share

Content