2025 METAL Price Prediction: Analyzing Market Trends and Factors Influencing Future Valuations

Introduction: METAL's Market Position and Investment Value

Metal Blockchain Token (METAL), as an extensible zero layer blockchain, has made significant strides since its inception. As of 2025, METAL's market capitalization has reached $51,495,061, with a circulating supply of approximately 186,481,719 tokens, and a price hovering around $0.27614. This asset, often referred to as a "PoS enabler," is playing an increasingly crucial role in the field of blockchain interoperability and decentralized finance (DeFi).

This article will provide a comprehensive analysis of METAL's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. METAL Price History Review and Current Market Status

METAL Historical Price Evolution

- 2022: METAL reached its all-time high of $1.65 on September 12, marking a significant milestone for the project

- 2024: The market experienced a downturn, with METAL hitting its all-time low of $0.035 on August 5

- 2025: METAL has shown strong recovery, with a 420.33% increase over the past year

METAL Current Market Situation

As of October 23, 2025, METAL is trading at $0.27614, experiencing a slight decline of 3.92% in the last 24 hours. The token has a market capitalization of $51,495,061, ranking it at 599th position in the overall cryptocurrency market. METAL's trading volume in the past 24 hours stands at $23,762.73, indicating moderate market activity.

The current price represents a significant recovery from its all-time low but remains well below its historical peak. METAL has shown strong performance over the past year with a 420.33% increase, despite recent short-term downtrends of -9.5% over the week and -28.64% over the month.

The token's circulating supply is 186,481,719.32 METAL, which is approximately 27.97% of its total supply of 333,333,333 tokens. The fully diluted market cap is estimated at $184,093,333.

Click to view the current METAL market price

Here's the content in English as requested:

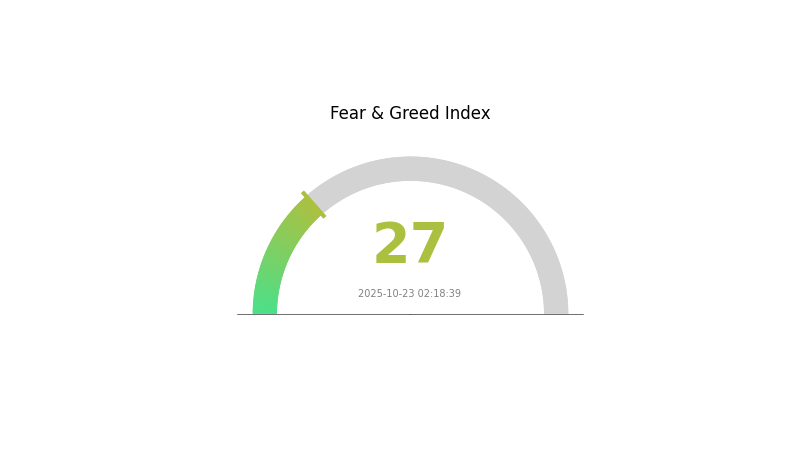

METAL Market Sentiment Indicator

2025-10-23 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious, with the Fear and Greed Index at 27, indicating a state of fear. This suggests investors are hesitant and potentially looking for buying opportunities. During such periods, it's crucial to conduct thorough research and consider dollar-cost averaging strategies. Remember, market sentiment can shift rapidly, so stay informed and manage your risk appropriately. Gate.com offers tools to help navigate these market conditions effectively.

METAL Holdings Distribution

The address holdings distribution data for METAL reveals an interesting pattern in token concentration. With no specific wallet addresses holding significant percentages of the total supply, METAL appears to have a relatively decentralized distribution. This lack of dominant holders suggests a reduced risk of market manipulation by large individual actors.

The absence of heavily concentrated holdings is generally viewed positively in the cryptocurrency space, as it indicates a more equitable distribution among participants. This distribution pattern may contribute to increased market stability for METAL, as there are fewer large holders who could potentially cause significant price swings through large-scale buying or selling activities.

However, it's important to note that while the current distribution seems favorable for decentralization, the cryptocurrency market is dynamic, and ownership patterns can change rapidly. Continuous monitoring of METAL's address holdings distribution will be crucial for assessing its long-term market structure and potential vulnerabilities.

Click to view the current METAL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting METAL's Future Price

Supply Mechanism

- Mining and Production: The mining situation, production technology advancements, and force majeure factors like natural disasters all affect the supply of non-ferrous metals.

- Historical Patterns: Supply changes have historically had significant impacts on metal prices.

- Current Impact: Recent supply constraints and export controls have led to price increases in some metals.

Institutional and Major Player Dynamics

- Institutional Holdings: Major institutions are showing increased interest in metals as a hedge against currency depreciation.

- Corporate Adoption: New energy vehicles, photovoltaics, and other emerging industries are driving increased demand for metals.

- National Policies: Export control policies, especially for rare earth elements, are strengthening China's competitive advantage in the entire industrial chain.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's interest rate cuts and global liquidity easing are weakening the dollar and supporting metal prices.

- Inflation Hedging Properties: Metals, especially precious metals, are gaining attention as hard currencies to counter currency depreciation.

- Geopolitical Factors: International tensions and resource nationalism are contributing to supply tightness and price volatility.

Technological Developments and Ecosystem Building

- Energy Transition: The shift towards renewable energy and electric vehicles is creating structural, long-cycle demand changes for metals like copper, aluminum, lithium, and rare earth magnets.

- Manufacturing Revival: As manufacturing sectors begin to recover, particularly in high-tech areas, demand for metals is expected to increase.

- Ecosystem Applications: Metals are increasingly seen as critical components in semiconductors, military technology, and other advanced industries, enhancing their strategic value.

III. METAL Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.14078 - $0.22368

- Neutral forecast: $0.22368 - $0.27604

- Optimistic forecast: $0.27604 - $0.33677 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing volatility

- Price range prediction:

- 2027: $0.27889 - $0.39453

- 2028: $0.27549 - $0.50323

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.38304 - $0.46139 (assuming steady market growth and adoption)

- Optimistic scenario: $0.46139 - $0.48750 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $0.48750 - $0.50323 (assuming breakthrough use cases and mainstream integration)

- 2030-12-31: METAL $0.48446 (potential peak before year-end consolidation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.33677 | 0.27604 | 0.14078 | 0 |

| 2026 | 0.37381 | 0.3064 | 0.22368 | 10 |

| 2027 | 0.39453 | 0.34011 | 0.27889 | 23 |

| 2028 | 0.50323 | 0.36732 | 0.27549 | 33 |

| 2029 | 0.4875 | 0.43527 | 0.38304 | 57 |

| 2030 | 0.48446 | 0.46139 | 0.33681 | 67 |

IV. METAL Professional Investment Strategies and Risk Management

METAL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate METAL tokens during market dips

- Store tokens in secure wallets for extended periods

- Regularly monitor project developments and market trends

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Assess overbought or oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage downside risk

METAL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for METAL

METAL Market Risks

- Volatility: High price fluctuations common in crypto markets

- Competition: Emerging L0 blockchain projects may impact METAL's market share

- Liquidity: Limited trading volumes could affect price stability

METAL Regulatory Risks

- Regulatory uncertainty: Changing crypto regulations may impact METAL's operations

- Compliance challenges: Potential difficulties in adhering to evolving global standards

- Legal status: Unclear classification of METAL tokens in various jurisdictions

METAL Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the blockchain code

- Scalability issues: Challenges in handling increased network activity

- Interoperability concerns: Compatibility issues with other blockchain networks

VI. Conclusion and Action Recommendations

METAL Investment Value Assessment

METAL presents a high-risk, high-potential investment opportunity in the L0 blockchain space. While offering innovative technology, it faces significant market, regulatory, and technical challenges.

METAL Investment Recommendations

✅ Beginners: Consider small, experimental positions after thorough research ✅ Experienced investors: Implement a balanced approach with proper risk management ✅ Institutional investors: Conduct comprehensive due diligence and consider as part of a diversified crypto portfolio

METAL Trading Participation Methods

- Spot trading: Buy and sell METAL tokens on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore decentralized finance options using METAL tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Are metal prices expected to rise?

Metal prices are expected to rise due to stimulus packages, but may be tempered by a sluggish real estate sector. Aluminum prices increased in 2024 due to a shortage of alumina.

Will silver ever reach $100 an ounce?

While possible, it's unlikely in the near future. Silver would need extreme economic conditions to reach $100/oz, which isn't expected soon.

What is the metal market outlook for 2025?

The metal market is expected to grow steadily in 2025, with single-digit percentage increases. Critical and battery metals like lithium, nickel, and cobalt will see the fastest growth, driven by demand from electric vehicles and renewable energy sectors.

How much will steel cost in 2025?

Steel prices in 2025 are expected to rise 5-10% due to tariffs and supply chain impacts. Further increases may follow as the market adjusts to new economic conditions.

Share

Content