2025 IOTA Price Prediction: Analyzing Growth Potential and Market Trends for the Internet of Things Cryptocurrency

Introduction: IOTA's Market Position and Investment Value

IOTA (IOTA), as a pioneering cryptocurrency focused on machine-to-machine (M2M) transactions, has made significant strides since its inception in 2015. As of 2025, IOTA's market capitalization has reached $574,921,016, with a circulating supply of approximately 4,094,879,037 tokens, and a price hovering around $0.1404. This asset, often hailed as the "Tangle Technology," is playing an increasingly crucial role in the Internet of Things (IoT) and machine economy.

This article will provide a comprehensive analysis of IOTA's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to offer professional price predictions and practical investment strategies for investors.

I. IOTA Price History Review and Current Market Status

IOTA Historical Price Evolution

- 2017: IOTA reached its all-time high of $5.25 on December 19, 2017, during the cryptocurrency bull market.

- 2020: IOTA hit its all-time low of $0.081637 on March 13, 2020, amidst the global market crash due to the COVID-19 pandemic.

- 2021-2022: IOTA experienced price fluctuations in line with the broader cryptocurrency market cycles.

IOTA Current Market Situation

As of October 17, 2025, IOTA is trading at $0.1404, with a market capitalization of $574,921,016.79. The token has seen a 24-hour price decrease of 4.16%. IOTA's current price is significantly below its all-time high, indicating a bearish trend in the medium term. The token's 24-hour trading volume stands at $450,730.29, suggesting moderate market activity. IOTA's market dominance is relatively low at 0.016%, reflecting its position as a mid-cap cryptocurrency in the overall market.

Click to view the current IOTA market price

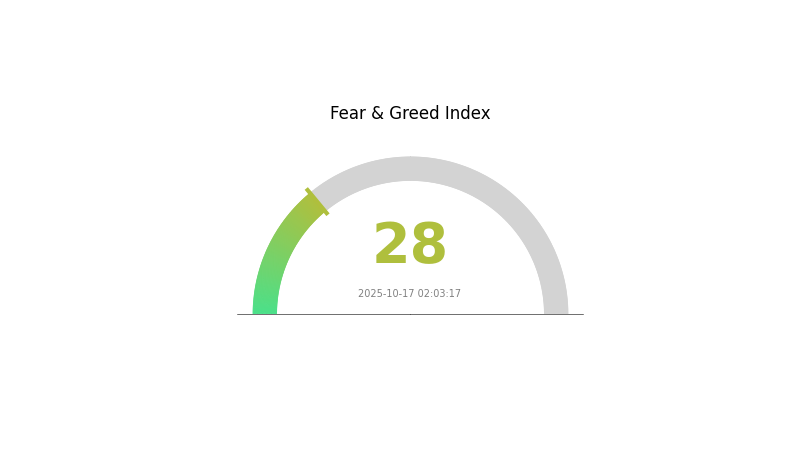

IOTA Market Sentiment Indicator

2025-10-17 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment for IOTA remains cautious as the Fear and Greed Index stands at 28, indicating a state of fear. This suggests investors are hesitant and risk-averse. During such periods, savvy traders often view it as a potential buying opportunity, adhering to the adage "be greedy when others are fearful." However, it's crucial to conduct thorough research and consider multiple factors before making any investment decisions in the volatile crypto market.

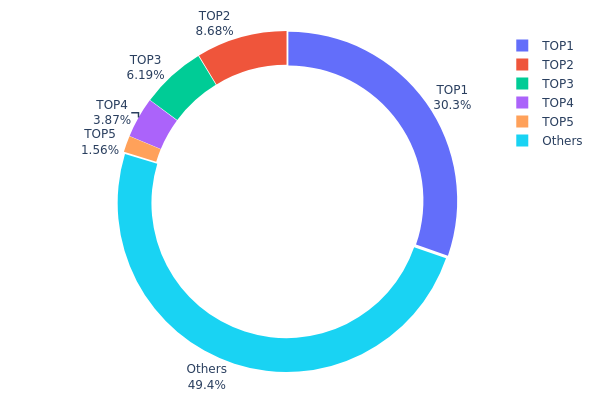

IOTA Holdings Distribution

The address holdings distribution data reveals a significant concentration of IOTA tokens among a few top addresses. The largest holder controls approximately 30.29% of the total supply, with 63,166.35K IOTA tokens. The top five addresses collectively hold 50.57% of the total supply, indicating a high level of centralization.

This concentration raises concerns about market stability and potential price manipulation. With nearly a third of the supply controlled by a single address, there's a risk of large-scale sell-offs or accumulation that could dramatically impact IOTA's market dynamics. The second and third largest holders, with 8.67% and 6.19% respectively, also wield considerable influence.

Despite the top-heavy distribution, it's noteworthy that 49.43% of IOTA tokens are held by addresses outside the top five. This suggests a degree of decentralization among smaller holders, which could potentially act as a buffer against extreme market movements initiated by the largest stakeholders. However, the overall structure indicates a need for increased distribution to enhance network resilience and market stability.

Click to view current IOTA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0c50...38f70e | 63166.35K | 30.29% |

| 2 | 0x4368...26f042 | 18090.95K | 8.67% |

| 3 | 0xc882...84f071 | 12915.07K | 6.19% |

| 4 | 0x2e8f...725e64 | 8065.44K | 3.86% |

| 5 | 0x0b07...52967e | 3259.54K | 1.56% |

| - | Others | 103008.71K | 49.43% |

II. Key Factors Affecting IOTA's Future Price

Institutional and Whale Dynamics

- Corporate Adoption: Partnerships with major players like the United Arab Emirates have been established, with other collaborations yet to be disclosed.

Macroeconomic Environment

- Inflation Hedging Properties: IOTA's performance in inflationary environments is influenced by global economic conditions and crypto market volatility.

- Geopolitical Factors: International situations impact IOTA's price and market performance.

Technological Development and Ecosystem Building

- DAG Technology: IOTA utilizes Directed Acyclic Graph (DAG) architecture, enabling parallel transaction processing, high throughput, and efficient validation without bottlenecks or congested memory pools.

- Smart Contract Integration: IOTA has integrated Move programming language for smart contracts, offering advanced programmability through its DAG consensus mechanism and object-oriented ledger model.

- Multi-VM Support: The network uses MoveVM as its primary execution environment for secure smart contract development, while the second-layer IOTA EVM ensures compatibility with Ethereum-based Solidity contracts.

- Ecosystem Applications: IOTA's framework addresses pain points in the Internet of Things (IoT) industry with advantages such as zero transaction fees and extremely fast confirmation speeds.

III. IOTA Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.13367 - $0.14070

- Neutral forecast: $0.14070 - $0.14633

- Optimistic forecast: $0.14633 - $0.15000 (requires strong market recovery)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range predictions:

- 2027: $0.11514 - $0.17677

- 2028: $0.14744 - $0.17625

- Key catalysts: Technological advancements in IoT, wider adoption of IOTA's Tangle technology

2029-2030 Long-term Outlook

- Base scenario: $0.17286 - $0.20657 (assuming steady market growth)

- Optimistic scenario: $0.20657 - $0.24027 (with accelerated adoption in IoT sector)

- Transformative scenario: $0.24027 - $0.30778 (with breakthrough applications and partnerships)

- 2030-12-31: IOTA $0.30778 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.14633 | 0.1407 | 0.13367 | 0 |

| 2026 | 0.18083 | 0.14351 | 0.11768 | 2 |

| 2027 | 0.17677 | 0.16217 | 0.11514 | 15 |

| 2028 | 0.17625 | 0.16947 | 0.14744 | 20 |

| 2029 | 0.24027 | 0.17286 | 0.11236 | 23 |

| 2030 | 0.30778 | 0.20657 | 0.1322 | 47 |

IV. Professional Investment Strategies and Risk Management for IOTA

IOTA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and long-term vision

- Operation suggestions:

- Accumulate IOTA during market dips

- Set price targets and rebalance portfolio periodically

- Store IOTA in secure wallets with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor IOTA's correlation with major cryptocurrencies

- Set strict stop-loss orders to manage downside risk

IOTA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across different cryptocurrencies and traditional assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official IOTA wallet

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for IOTA

IOTA Market Risks

- Volatility: IOTA's price can experience significant fluctuations

- Liquidity: Lower trading volume compared to major cryptocurrencies

- Competition: Emerging IoT-focused blockchain projects may challenge IOTA's market position

IOTA Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on cryptocurrencies

- Cross-border transactions: Varying legal status in different jurisdictions

- Tax implications: Evolving tax laws for cryptocurrency transactions and holdings

IOTA Technical Risks

- Network scalability: Challenges in handling increased transaction volume

- Security vulnerabilities: Potential for undiscovered flaws in the Tangle architecture

- Adoption hurdles: Difficulty in achieving widespread integration with IoT devices

VI. Conclusion and Action Recommendations

IOTA Investment Value Assessment

IOTA presents a unique value proposition in the IoT and M2M economy, with potential for long-term growth. However, short-term volatility and technical challenges pose significant risks.

IOTA Investment Recommendations

✅ Beginners: Consider small, experimental positions to understand the technology

✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management

✅ Institutional investors: Conduct thorough due diligence and consider IOTA as part of a diversified crypto portfolio

IOTA Trading Participation Methods

- Spot trading: Buy and sell IOTA on Gate.com's spot market

- Staking: Participate in IOTA staking programs if available

- DeFi: Explore decentralized finance options involving IOTA tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does IOTA have a future?

Yes, IOTA has a promising future. Its innovative technology and real-world applications position it well for growth in the evolving crypto market.

What will the price of IOTA be in 2030?

Based on current projections, IOTA's price in 2030 could range from $0.1204 to $1.301. This estimate considers market trends and potential adoption rates.

Can IOTA reach $1000 dollars?

Yes, IOTA could potentially reach $1000. With increasing IoT adoption and smart city developments, IOTA's unique technology positions it for significant growth in the future.

What are the risks of investing in IOTA?

IOTA investment risks include high volatility, uncertain long-term viability, and the nascent state of the crypto market. Its value can fluctuate widely, and past performance doesn't guarantee future results.

Share

Content