2025 ETH Price Prediction: Analyzing Market Trends and Institutional Adoption Factors

Introduction: ETH's Market Position and Investment Value

Ethereum (ETH), as the leading platform for decentralized applications and smart contracts, has achieved significant milestones since its inception in 2015. As of 2025, Ethereum's market capitalization has reached $528.61 billion, with a circulating supply of approximately 120,705,000 coins, and a price hovering around $4,379.39. This asset, often hailed as the "World Computer," is playing an increasingly crucial role in decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain-based applications.

This article will comprehensively analyze Ethereum's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide professional price predictions and practical investment strategies for investors.

I. ETH Price History Review and Current Market Status

ETH Historical Price Evolution

- 2015: Ethereum launched, price started at $0.432979

- 2017: ICO boom, price surged to over $1,400

- 2018-2019: Crypto winter, price dropped to around $100

- 2021: Bull market, price reached all-time high of $4,946.05

- 2022-2023: Market correction, price fluctuated between $1,000-$2,000

- 2025: Recovery phase, price climbed back to $4,379.39

ETH Current Market Situation

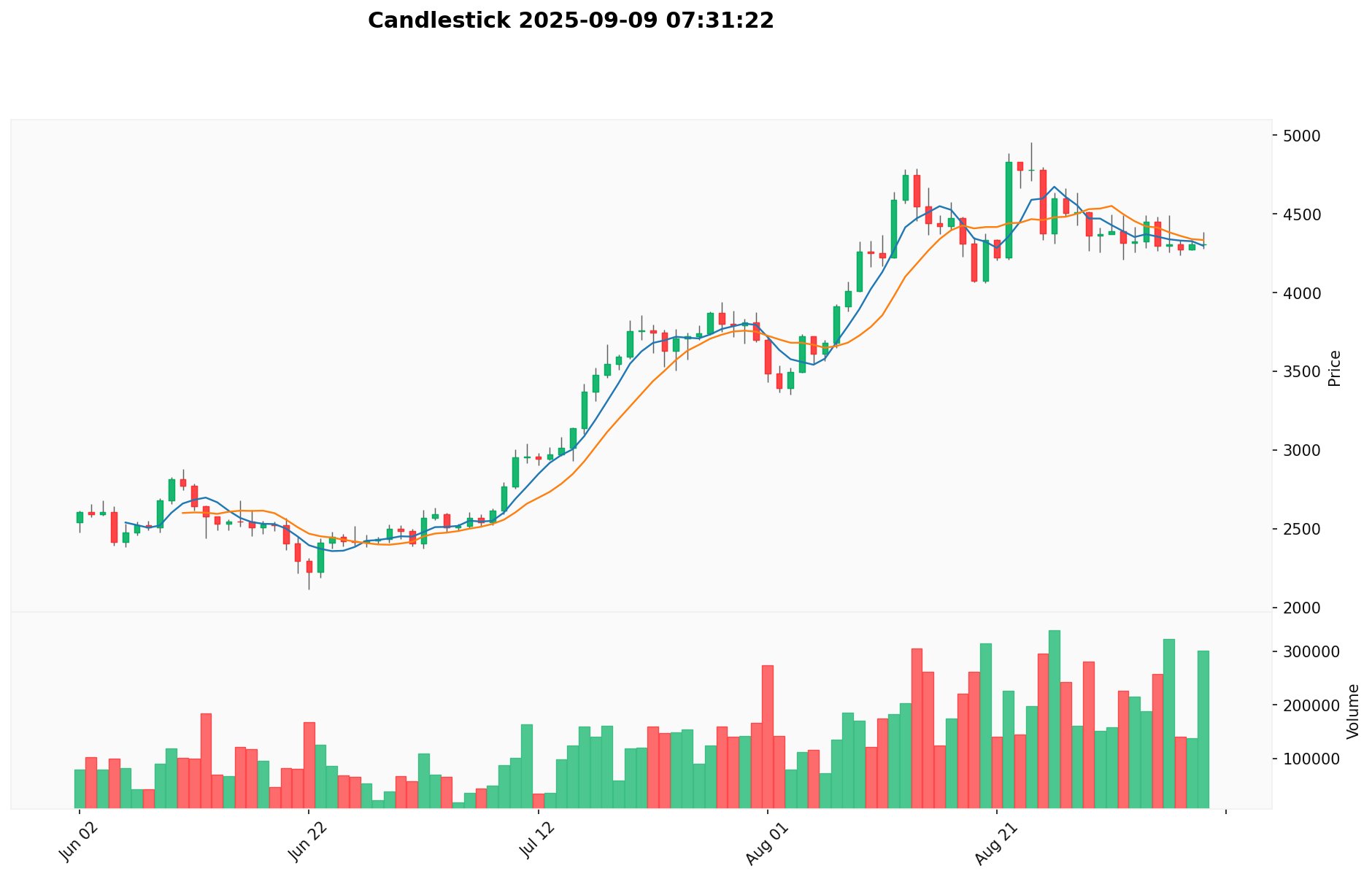

As of September 9, 2025, Ethereum (ETH) is trading at $4,379.39, with a 24-hour trading volume of $1,439,596,524. The current market cap stands at $528,614,271,986, ranking ETH as the second-largest cryptocurrency by market capitalization. ETH has shown positive momentum in the past 24 hours, with a 1.59% increase in price. The 7-day performance indicates a slight dip of -0.98%, while the 30-day and 1-year trends show gains of 3.40% and 90.27% respectively. The current price is approaching its all-time high of $4,946.05, set on August 25, 2025, suggesting strong market confidence in Ethereum's long-term prospects.

Click to view the current ETH market price

Here's the content in English as requested:

ETH Market Sentiment Indicator

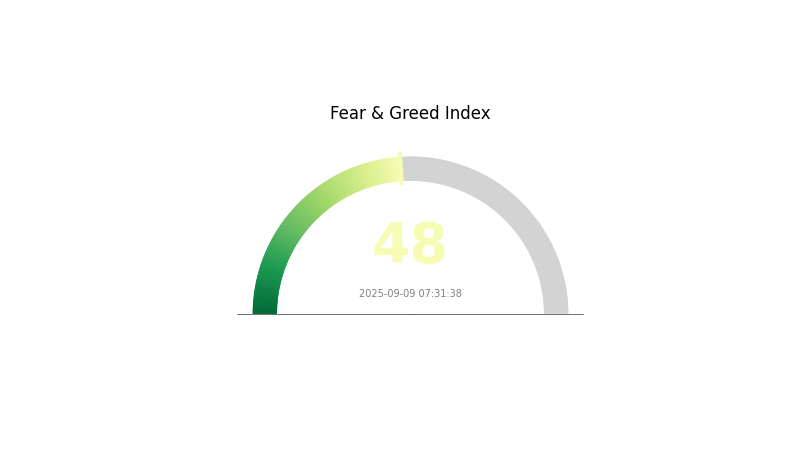

2025-09-09 Fear and Greed Index: 48 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment for Ethereum remains balanced, with the Fear and Greed Index at 48. This neutral reading suggests investors are neither overly pessimistic nor excessively optimistic. It's a prime opportunity for traders to reassess their strategies and consider dollar-cost averaging. Remember, market sentiment can shift rapidly, so stay informed and manage your risk wisely. Gate.com offers comprehensive tools to help you navigate these market conditions effectively.

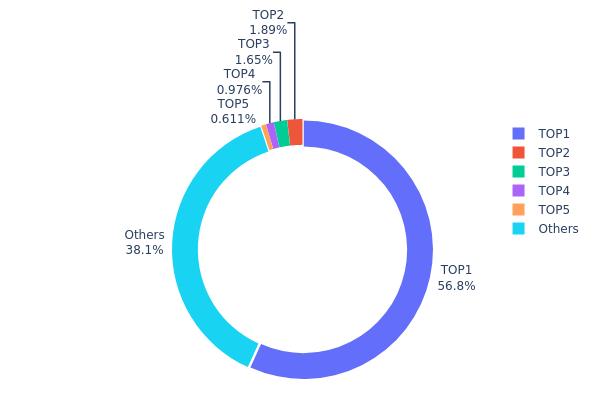

ETH Holdings Distribution

The address holdings distribution data reveals significant concentration in Ethereum ownership. The top address holds a staggering 56.78% of all ETH, indicating a high level of centralization. This concentration raises concerns about market manipulation and volatility risks. The top 5 addresses collectively control over 61% of the total supply, further emphasizing the skewed distribution.

Such concentration could potentially impact market dynamics, as large holders (often referred to as "whales") have the capacity to influence prices through significant buy or sell orders. This centralization also poses challenges to Ethereum's goal of decentralization, as it suggests a small number of entities have disproportionate control over the network.

However, it's worth noting that 38.09% of ETH is distributed among other addresses, indicating some level of broader participation. This distribution pattern reflects a complex market structure, balancing between centralized influence and wider adoption, which could affect Ethereum's long-term stability and growth potential.

Click to view the current ETH Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...7705fa | 68534.08K | 56.78% |

| 2 | 0xc02a...756cc2 | 2277.15K | 1.89% |

| 3 | 0xbe0e...4d33e8 | 1996.01K | 1.65% |

| 4 | 0x40b3...18e489 | 1177.79K | 0.98% |

| 5 | 0x4904...74e97e | 737.33K | 0.61% |

| - | Others | 45982.71K | 38.09% |

II. Key Factors Influencing ETH's Future Price

Supply Mechanism

- EIP-1559: This mechanism burns a portion of transaction fees, potentially making ETH deflationary over time.

- Historical Pattern: Previous supply changes have generally led to price increases due to reduced circulating supply.

- Current Impact: The ongoing fee burning is expected to continue supporting ETH's price by reducing overall supply.

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions like BlackRock have shown increased interest in ETH through ETF proposals.

- Corporate Adoption: Companies like Bit Digital and Bitmine Immersion Technologies have significantly increased their ETH holdings.

- Government Policies: There are indications of potential inclusion of cryptocurrencies in 401(k) retirement plans, which could boost institutional demand for ETH.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly those of the Federal Reserve, continue to influence crypto market sentiment.

- Inflation Hedge Properties: ETH is increasingly viewed as a potential hedge against inflation, similar to Bitcoin.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions can drive investors towards cryptocurrencies like ETH.

Technological Developments and Ecosystem Growth

- Ethereum 2.0: The ongoing transition to Proof of Stake is expected to significantly improve scalability and energy efficiency.

- Layer 2 Solutions: The development of Layer 2 scaling solutions is enhancing Ethereum's transaction capacity and reducing fees.

- Ecosystem Applications: Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs) continue to drive usage and adoption of the Ethereum network.

III. ETH Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $3,580 - $4,000

- Neutral forecast: $4,000 - $4,700

- Optimistic forecast: $4,700 - $5,327 (requires continued Ethereum network upgrades and adoption)

2027-2028 Outlook

- Market phase expectation: Potential bull market cycle

- Price range predictions:

- 2027: $3,292 - $7,041

- 2028: $4,661 - $8,716

- Key catalysts: Ethereum 2.0 full implementation, increased DeFi and NFT adoption

2029-2030 Long-term Outlook

- Base case scenario: $7,000 - $8,000 (assuming steady network growth and adoption)

- Optimistic scenario: $8,000 - $9,000 (with accelerated institutional adoption)

- Transformative scenario: $9,000 - $9,491 (with mainstream Ethereum integration in finance and tech)

- 2030-12-31: ETH $7,975 (potential new all-time high)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 5327.73 | 4366.99 | 3580.93 | 0 |

| 2026 | 5283.62 | 4847.36 | 4556.52 | 10 |

| 2027 | 7041.03 | 5065.49 | 3292.57 | 15 |

| 2028 | 8716.7 | 6053.26 | 4661.01 | 38 |

| 2029 | 8566.57 | 7384.98 | 4874.09 | 68 |

| 2030 | 9491.17 | 7975.78 | 4944.98 | 82 |

IV. Professional ETH Investment Strategies and Risk Management

ETH Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Ethereum's technology

- Operation suggestions:

- Accumulate ETH during market dips

- Stake ETH to earn passive income

- Store in secure, non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Helps gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor key support and resistance levels

- Stay updated on Ethereum network upgrades and developments

ETH Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-5% of portfolio

- Moderate investors: 5-15% of portfolio

- Aggressive investors: 15-30% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different cryptocurrencies and traditional assets

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Use two-factor authentication, backup private keys securely

V. Potential Risks and Challenges for ETH

ETH Market Risks

- High volatility: ETH price can experience significant swings

- Competition: Other smart contract platforms may gain market share

- Macro-economic factors: Global economic conditions can impact crypto markets

ETH Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations in various jurisdictions

- SEC classification: Ongoing debate about ETH's status as a security

- Tax implications: Evolving tax laws may affect ETH investments

ETH Technical Risks

- Network congestion: High transaction fees during peak usage

- Smart contract vulnerabilities: Potential for exploits in DApps built on Ethereum

- Scalability challenges: Ongoing need for network upgrades to improve throughput

VI. Conclusion and Action Recommendations

ETH Investment Value Assessment

Ethereum has strong long-term potential due to its dominant position in the smart contract and DeFi ecosystem. However, short-term volatility and ongoing technical challenges present risks.

ETH Investment Recommendations

✅ Beginners: Start with small, regular investments to build a position over time ✅ Experienced investors: Consider a mix of holding and active trading based on market conditions ✅ Institutional investors: Explore ETH as part of a diversified crypto portfolio, potentially including staking

ETH Trading Participation Methods

- Spot trading: Buy and sell ETH directly on Gate.com

- Futures trading: Use ETH futures contracts for leveraged exposure or hedging

- Staking: Participate in Ethereum 2.0 staking through Gate.com's staking services

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much will 1 Ethereum be worth in 2025?

Based on current projections, 1 Ethereum is expected to be worth between $6,200 and $9,345 in 2025, with an average price of $4,567.

What is the ETH prediction for 2030?

ETH is predicted to reach $10,000 by 2030, driven by its strong market position and continued technological advancements in blockchain.

Will Ethereum hit $10,000?

Yes, Ethereum could potentially hit $10,000 by 2025, driven by increased adoption, network upgrades, and overall crypto market growth.

Will Ethereum reach $50,000?

Yes, Ethereum could potentially reach $50,000 in the future. Its growing adoption, technological advancements, and the shift to Ethereum 2.0 may drive significant price appreciation over time.

Share

Content