2025 BTT Price Prediction: Analyzing Potential Growth and Market Trends for BitTorrent Token

Introduction: BTT's Market Position and Investment Value

BitTorrent (BTT), as a leading decentralized file-sharing protocol token, has achieved significant milestones since its inception in 2019. As of 2025, BitTorrent's market capitalization has reached $505,060,517, with a circulating supply of approximately 986,061,142,857,000 tokens, and a price hovering around $0.0000005122. This asset, often referred to as the "decentralized content distribution pioneer," is playing an increasingly crucial role in peer-to-peer file sharing and content delivery networks.

This article will comprehensively analyze BTT's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. BTT Price History Review and Current Market Status

BTT Historical Price Evolution

- 2019: BTT launched, price fluctuated around $0.0004

- 2021: Bull market peak, price reached all-time high of $0.00000343

- 2023: Market downturn, price dropped to all-time low of $0.000000365368

BTT Current Market Situation

As of October 17, 2025, BTT is trading at $0.0000005122. The token has experienced a slight decline of 0.42% in the past 24 hours. Over the past week, BTT has seen a significant drop of 12.46%, while the 30-day and 1-year performance show declines of 20.22% and 45.01% respectively. The current market capitalization stands at $505,060,517, ranking BTT at 152nd in the global cryptocurrency market. The 24-hour trading volume is $167,393, indicating moderate market activity.

Click to view the current BTT market price

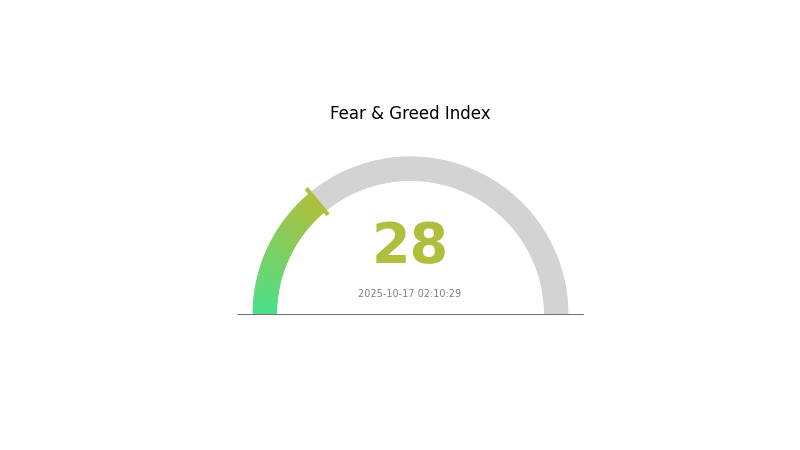

BTT Market Sentiment Indicator

2025-10-17 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the Fear and Greed Index standing at 28. This indicates a cautious sentiment among investors, potentially signaling an opportunity for contrarian strategies. During such times, it's crucial to remain vigilant and conduct thorough research before making investment decisions. Remember, market cycles are inherent in the crypto space, and periods of fear often precede potential rebounds. Stay informed and consider diversifying your portfolio to manage risk effectively.

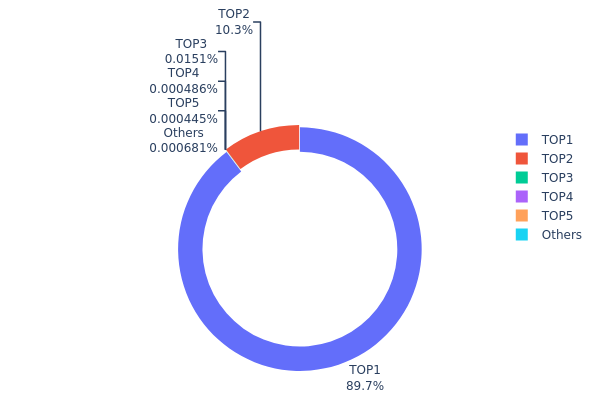

BTT Holdings Distribution

The address holdings distribution data for BTT reveals a highly concentrated ownership structure. The top address holds an overwhelming 89.71% of the total supply, while the second-largest address controls 10.27%. This extreme concentration suggests that BTT's circulating supply is largely controlled by a small number of entities or individuals.

Such a concentrated distribution raises concerns about market manipulation and price volatility. With over 99% of the tokens held by just two addresses, there is a significant risk of large sell-offs or buy-ins that could dramatically impact the token's price. This concentration also undermines the principle of decentralization, which is a core tenet of many cryptocurrency projects.

From a market structure perspective, this distribution indicates a potentially fragile ecosystem for BTT. The high concentration of tokens in few hands could lead to reduced liquidity and increased susceptibility to market shocks, potentially deterring broader adoption and investment in the token.

Click to view the current BTT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | TYznsE...nKvR7Q | 54083576499999992.00K | 89.71% |

| 2 | TY4idz...8Rzz28 | 6192530794020000.00K | 10.27% |

| 3 | TPdgMR...7NwQQX | 9105000000000.00K | 0.01% |

| 4 | TASUAU...F4NKot | 292871176338.27K | 0.00% |

| 5 | TWpMnU...vKzQo2 | 268187033531.31K | 0.00% |

| - | Others | 410578558492.67K | 0.010000000000005% |

II. Key Factors Affecting BTT's Future Price

Supply Mechanism

- Halving Event: The upcoming Bitcoin halving event may indirectly impact BTT's price, as it often influences the broader cryptocurrency market.

- Historical Pattern: Historically, halving events have led to increased market activity and potential price appreciation.

- Current Impact: Investors may anticipate price increases leading up to the halving, potentially driving BTT's price upward.

Institutional and Whale Movements

- Institutional Holdings: An increase in institutional investors entering the cryptocurrency market could positively impact BTT's price.

- Corporate Adoption: If major corporations show interest in BitTorrent technology or BTT, it could drive up demand and price.

Macroeconomic Environment

- Monetary Policy Impact: Global economic uncertainty may lead investors to seek alternative assets, potentially benefiting BTT.

- Inflation Hedging Properties: BTT may be viewed as a potential hedge against inflation, similar to Bitcoin's "digital gold" status.

- Geopolitical Factors: International economic and political developments can influence investor sentiment towards cryptocurrencies, including BTT.

Technical Development and Ecosystem Building

- Marketing Initiatives: If the BitTorrent team implements measures to attract marketing professionals, it could boost BTT's trading volume and price.

- Ecosystem Applications: Development of DApps or ecosystem projects utilizing BTT could enhance its utility and value proposition.

III. BTT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00000150 - $0.00000180

- Neutral prediction: $0.00000180 - $0.00000220

- Optimistic prediction: $0.00000220 - $0.00000250 (requires increased adoption of BitTorrent File System)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased utility

- Price range forecast:

- 2027: $0.00000250 - $0.00000350

- 2028: $0.00000350 - $0.00000450

- Key catalysts: Integration with more decentralized applications, improvements in BitTorrent Speed

2029-2030 Long-term Outlook

- Base scenario: $0.00000500 - $0.00000600 (assuming steady growth in BTFS adoption)

- Optimistic scenario: $0.00000600 - $0.00000700 (assuming widespread integration in decentralized storage solutions)

- Transformative scenario: $0.00000700 - $0.00000800 (assuming BTT becomes a leading token in decentralized content distribution)

- 2030-12-31: BTT $0.00000750 (potential peak if market conditions remain favorable)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0 | 0 | 0 | 0 |

| 2026 | 0 | 0 | 0 | 20 |

| 2027 | 0 | 0 | 0 | 42 |

| 2028 | 0 | 0 | 0 | 75 |

| 2029 | 0 | 0 | 0 | 98 |

| 2030 | 0 | 0 | 0 | 142 |

IV. BTT Professional Investment Strategies and Risk Management

BTT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operational suggestions:

- Accumulate BTT during market dips

- Set price targets for partial profit-taking

- Store BTT in secure cold wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and support/resistance levels

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Follow the overall market trend

- Set strict stop-loss orders

BTT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-20%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official BitTorrent wallet

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for BTT

BTT Market Risks

- High volatility: BTT price can fluctuate dramatically

- Competition: Other decentralized file-sharing projects may emerge

- Market sentiment: Overall crypto market conditions can impact BTT

BTT Regulatory Risks

- Uncertain regulations: Cryptocurrency regulations are still evolving globally

- Potential restrictions: Some countries may limit or ban crypto trading

- Tax implications: Unclear tax treatment in many jurisdictions

BTT Technical Risks

- Network congestion: High traffic could slow down transactions

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: May face issues as user base grows

VI. Conclusion and Action Recommendations

BTT Investment Value Assessment

BTT offers potential long-term value in the decentralized file-sharing space but faces short-term volatility and regulatory uncertainties.

BTT Investment Recommendations

✅ Beginners: Start with small positions, focus on learning ✅ Experienced investors: Consider BTT as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence, monitor regulatory developments

BTT Trading Participation Methods

- Spot trading: Buy and hold BTT on Gate.com

- Staking: Participate in BTT staking programs for passive income

- DeFi: Explore decentralized finance opportunities involving BTT

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will BitTorrent coin reach $1 dollar?

While possible, reaching $1 is challenging for BitTorrent coin. It depends on market growth, adoption, and overall crypto trends. Significant developments could drive its value up.

How much is BTT in 2025?

Based on predictions, BTT is expected to reach $0.064186 by October 27, 2025. The price range for 2025 is forecasted between $0.063695 and $0.065289.

How much will BitTorrent be worth in 2025?

BitTorrent is predicted to be worth around $0.068074 in 2025, with a potential price range between $0.063695 and $0.065289.

Is BTT a good investment?

BTT shows potential, with predictions suggesting a peak price of $0.00000345 by 2028. Its average price is expected to be $0.00000324, indicating possible growth opportunities for investors.

Share

Content