2025 BB Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: BB's Market Position and Investment Value

BounceBit (BB), as a pioneering BTC restaking infrastructure, has achieved significant milestones since its inception. As of 2025, BounceBit's market capitalization stands at $50,888,565, with a circulating supply of approximately 409,500,000 tokens, and a price hovering around $0.12427. This asset, hailed as the "BTC Yield Enabler," is playing an increasingly crucial role in empowering Bitcoin holders to earn yields across multiple networks.

This article will comprehensively analyze BounceBit's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. BB Price History Review and Current Market Status

BB Historical Price Evolution

- 2024: Initial launch, price peaked at $0.9 on May 13

- 2025: Market downturn, price dropped to an all-time low of $0.04755 on October 10

BB Current Market Situation

As of October 24, 2025, BB is trading at $0.12427, showing a 4.99% increase in the last 24 hours. The token has experienced significant volatility over the past year, with a 59.34% decline from its previous levels. Despite the recent daily gain, BB is still down 40.19% over the last 30 days, indicating a bearish trend in the medium term.

The current market capitalization stands at $50,888,565, with a circulating supply of 409,500,000 BB tokens. The fully diluted valuation is $260,967,000, based on the maximum supply of 2,100,000,000 tokens. BB's market dominance is relatively low at 0.0066%, suggesting it's a smaller player in the overall cryptocurrency market.

Trading volume in the past 24 hours reached $321,835.91, reflecting moderate market activity. The token is currently trading well below its all-time high of $0.9, but has shown some recovery from its recent all-time low.

Click to view the current BB market price

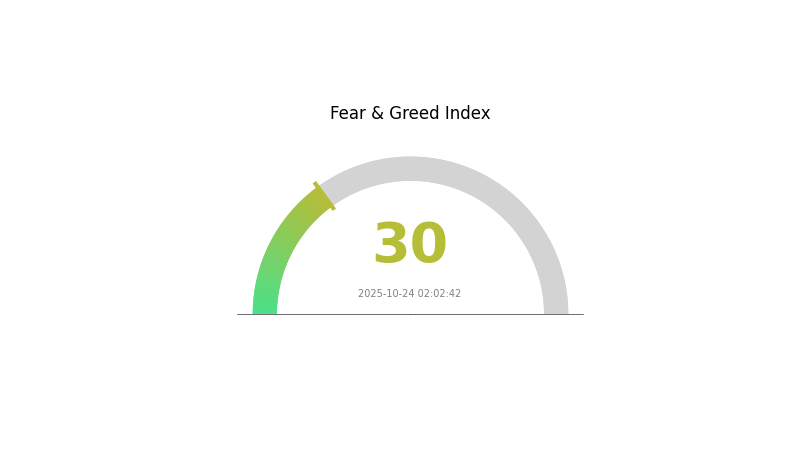

BB Market Sentiment Indicator

2025-10-24 Fear and Greed Index: 30 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment is currently in the "Fear" zone, with a reading of 30 on the Fear and Greed Index. This indicates a cautious mood among investors, potentially presenting buying opportunities for those with a contrarian strategy. However, it's crucial to remember that market sentiment can shift rapidly. Traders should stay vigilant, conduct thorough research, and consider using risk management tools available on platforms like Gate.com to navigate these uncertain conditions.

BB Holdings Distribution

The address holdings distribution chart provides valuable insights into the concentration of BB tokens across different addresses. Based on the data presented, it appears that the BB token distribution is currently showing a high degree of decentralization, with no single address holding a disproportionately large percentage of the total supply.

This distributed ownership structure suggests a healthy market environment for BB, as it reduces the risk of price manipulation by large holders. The absence of heavily concentrated positions also indicates a more stable on-chain structure, which can contribute to reduced volatility in the token's price movements. Furthermore, this distribution pattern aligns well with the principles of decentralization, potentially enhancing the token's resilience against sudden market shocks or coordinated selling pressure.

Overall, the current address distribution of BB reflects a mature market structure with a diverse holder base. This characteristic not only supports the token's liquidity but also enhances its potential for organic price discovery, making it an attractive asset for investors seeking projects with robust on-chain fundamentals.

Click to view the current BB Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing BB's Future Price

Institutional and Whale Dynamics

- National Policies: Global regulatory attitudes towards cryptocurrencies vary and are dynamic. Some U.S. states recognize cryptocurrencies, while federal agencies maintain strict oversight. China has banned related businesses, and the EU continues to refine its regulatory framework. Tightening regulations may impact listed companies involved in cryptocurrencies.

Macroeconomic Environment

- Monetary Policy Impact: Future central bank policies are expected to influence BB's price.

- Inflation Hedging Properties: BB's performance in inflationary environments may be a factor.

- Geopolitical Factors: International situations, such as conflicts like the Russia-Ukraine war, can affect energy markets and supply chains, potentially impacting BB's price.

Technical Development and Ecosystem Building

- Ecosystem Applications: The development of major DApps and ecosystem projects could influence BB's value.

III. BB Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.11309 - $0.12427

- Neutral prediction: $0.12427 - $0.14000

- Optimistic prediction: $0.14000 - $0.15782 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range prediction:

- 2027: $0.09013 - $0.22232

- 2028: $0.16019 - $0.27009

- Key catalysts: Increased adoption and technological improvements

2029-2030 Long-term Outlook

- Base scenario: $0.22818 - $0.24187 (assuming steady market growth)

- Optimistic scenario: $0.25556 - $0.36038 (assuming strong market performance)

- Transformative scenario: $0.36038 - $0.40000 (assuming breakthrough innovations)

- 2030-12-31: BB $0.24187 (94% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.15782 | 0.12427 | 0.11309 | 0 |

| 2026 | 0.15938 | 0.14105 | 0.08745 | 13 |

| 2027 | 0.22232 | 0.15021 | 0.09013 | 20 |

| 2028 | 0.27009 | 0.18627 | 0.16019 | 49 |

| 2029 | 0.25556 | 0.22818 | 0.19167 | 83 |

| 2030 | 0.36038 | 0.24187 | 0.13786 | 94 |

IV. BB Professional Investment Strategies and Risk Management

BB Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking exposure to BTC re-staking infrastructure

- Operation suggestions:

- Accumulate BB tokens during market dips

- Stake BB tokens on the BounceBit chain for additional yield

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Swing trading key points:

- Set stop-loss orders to limit potential losses

- Take profits at key resistance levels

BB Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple re-staking projects

- Options: Use put options to protect against downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, and regularly update firmware

V. BB Potential Risks and Challenges

BB Market Risks

- Price volatility: BB may experience significant price swings

- Competition: Other re-staking projects may gain market share

- BTC price correlation: BB value may be influenced by BTC price movements

BB Regulatory Risks

- Unclear regulations: Re-staking products may face regulatory scrutiny

- Cross-border compliance: Different jurisdictions may have varying stances on re-staking

- Tax implications: Unclear tax treatment of re-staking rewards

BB Technical Risks

- Smart contract vulnerabilities: Potential exploits in the re-staking infrastructure

- Scalability challenges: Network congestion during high demand periods

- Oracle failures: Inaccurate data feeds could disrupt re-staking operations

VI. Conclusion and Action Recommendations

BB Investment Value Assessment

BounceBit offers a unique value proposition in the BTC re-staking space, with potential for long-term growth. However, short-term risks include market volatility and regulatory uncertainties.

BB Investment Recommendations

✅ Beginners: Start with small positions and focus on education ✅ Experienced investors: Consider allocating a portion of BTC holdings to BB for yield optimization ✅ Institutional investors: Explore strategic partnerships and larger-scale re-staking opportunities

BB Trading Participation Methods

- Spot trading: Purchase BB tokens on Gate.com

- Staking: Participate in BounceBit's re-staking ecosystem

- Yield farming: Explore liquidity provision opportunities in BB pools

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will BB stock go?

Based on current predictions, BB stock could reach up to $4.90 by 2025 and potentially $2.47 by 2030. However, short-term forecasts suggest a stable price around $3.91.

What is BlackBerry worth in 2025?

BlackBerry's market cap is $2.75 billion in 2025, reflecting a 97.61% growth in one year. This represents the company's total value based on its stock price.

Is BB a good buy?

Yes, BB appears to be a good buy. Its growth potential and recent developments make it an attractive investment option in the Web3 and crypto space.

Is BlackBerry going to survive?

BlackBerry's survival depends on its AI and cybersecurity innovations. As of 2025, its future remains uncertain but promising.

Share

Content