2025 AUDIO Price Prediction: Will This Audio Protocol Token Reach New Heights?

Introduction: AUDIO's Market Position and Investment Value

Audius (AUDIO), as a decentralized music sharing and streaming protocol, has made significant strides since its inception in 2020. As of 2025, Audius has reached a market capitalization of $54,517,975, with a circulating supply of approximately 1,365,338,722 tokens, and a price hovering around $0.03993. This asset, often referred to as the "Web3 Spotify," is playing an increasingly crucial role in the music streaming and content creation industry.

This article will comprehensively analyze AUDIO's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment, to provide investors with professional price predictions and practical investment strategies.

I. AUDIO Price History Review and Current Market Status

AUDIO Historical Price Evolution

- 2020: AUDIO launched in October, with an initial price of $0.02

- 2021: Reached all-time high of $4.95 on March 27, a significant price surge

- 2025: Market downturn, price dropped to a new all-time low of $0.02790091 on October 11

AUDIO Current Market Situation

As of October 23, 2025, AUDIO is trading at $0.03993, representing a 99.19% decrease from its all-time high. The token has experienced a 1.4% decrease in the past 24 hours and a more substantial 10.68% decline over the past week. The 30-day performance shows a significant drop of 29.16%, indicating a bearish trend in the short to medium term.

AUDIO's market capitalization currently stands at $54,517,975, ranking it 579th in the overall cryptocurrency market. The token's 24-hour trading volume is $24,610, suggesting relatively low liquidity compared to its market cap.

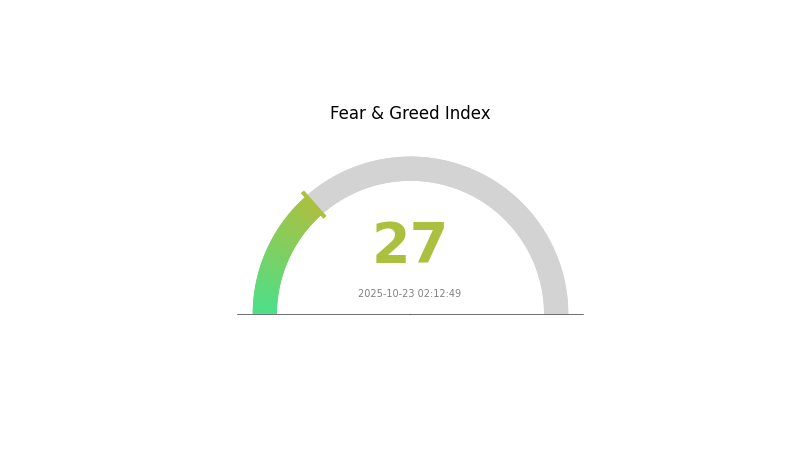

The current market sentiment for cryptocurrencies is characterized by fear, with the VIX index at 27. This cautious atmosphere may be contributing to the downward pressure on AUDIO's price.

Click to view the current AUDIO market price

AUDIO Market Sentiment Indicator

2025-10-23 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, as indicated by the Fear and Greed Index reading of 27. This suggests that investors are cautious and uncertain about the market's direction. During such times, it's crucial to stay informed and make rational decisions. Remember, periods of fear can sometimes present buying opportunities for long-term investors. However, always conduct thorough research and consider your risk tolerance before making any investment decisions. Stay vigilant and keep an eye on market trends as sentiments can shift quickly in the volatile crypto space.

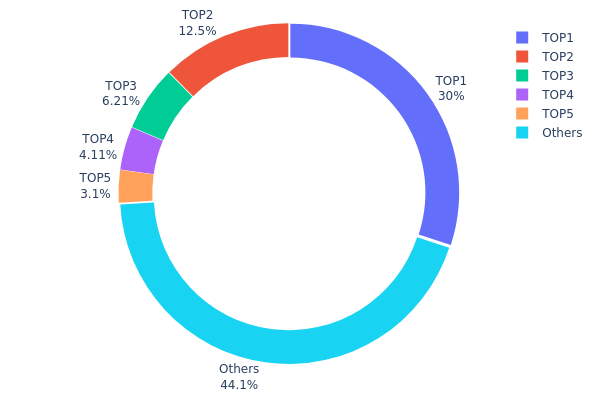

AUDIO Holdings Distribution

The address holdings distribution for AUDIO reveals a significant concentration of tokens among a few top addresses. The top holder possesses 30.03% of the total supply, while the top five addresses collectively control 55.88% of AUDIO tokens. This high concentration raises concerns about potential market manipulation and price volatility.

Such a centralized distribution structure could impact AUDIO's market dynamics. The substantial holdings by a few addresses may lead to increased price fluctuations if large volumes are moved. Moreover, this concentration potentially undermines the project's decentralization ethos, as a small number of entities hold considerable influence over the token's circulation and governance.

Despite these concerns, it's worth noting that 44.12% of AUDIO tokens are distributed among other addresses, indicating some level of wider participation. However, the current distribution pattern suggests a need for increased diversification to enhance market stability and reduce the risk of undue influence by major token holders.

Click to view the current AUDIO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe6d9...ae4591 | 410044.87K | 30.03% |

| 2 | 0xf977...41acec | 170000.00K | 12.45% |

| 3 | 0x76ec...78fbd3 | 84781.77K | 6.20% |

| 4 | 0x8563...6310cc | 56085.60K | 4.10% |

| 5 | 0x3ee1...8fa585 | 42353.43K | 3.10% |

| - | Others | 602073.05K | 44.12% |

II. Key Factors Influencing AUDIO's Future Price

Supply Mechanism

- Token Release Schedule: Periodic releases of AUDIO tokens based on a predetermined schedule may impact supply and price dynamics.

- Historical Patterns: Previous token releases have typically led to short-term price fluctuations, with potential selling pressure immediately following releases.

- Current Impact: The upcoming token release in Q4 2025 is expected to temporarily increase supply, potentially putting downward pressure on price.

Institutional and Whale Activity

- Institutional Holdings: Major investment firms and crypto funds have been gradually increasing their AUDIO positions throughout 2025.

- Corporate Adoption: Several music streaming platforms and record labels have announced partnerships or integrations with Audius, expanding its ecosystem.

- Government Policies: Regulatory clarity on crypto assets in key markets like the US and EU has provided a more favorable environment for institutional involvement.

Macroeconomic Environment

- Monetary Policy Impact: Expected interest rate cuts by major central banks in 2026 could increase risk appetite for crypto assets like AUDIO.

- Inflation Hedging Properties: AUDIO has shown some correlation with inflation hedging assets, potentially attracting investors during periods of high inflation.

- Geopolitical Factors: Ongoing global tensions and economic uncertainties may drive investors towards decentralized platforms, benefiting AUDIO.

Technical Development and Ecosystem Growth

- Protocol Upgrades: The upcoming "Harmony" upgrade aims to improve scalability and reduce transaction costs on the Audius network.

- Layer 2 Integration: Plans to implement Layer 2 solutions are expected to enhance network performance and user experience.

- Ecosystem Applications: New music NFT marketplaces and creator tools built on Audius are expanding the utility and demand for AUDIO tokens.

III. AUDIO Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.02917 - $0.03500

- Neutral forecast: $0.03500 - $0.04000

- Optimistic forecast: $0.04000 - $0.04276 (requires strong adoption of audio NFTs)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range predictions:

- 2027: $0.02965 - $0.07068

- 2028: $0.04804 - $0.06305

- Key catalysts: Expansion of decentralized audio platforms, integration with Web3 ecosystems

2029-2030 Long-term Outlook

- Base scenario: $0.05729 - $0.07000 (assuming steady growth in the audio streaming industry)

- Optimistic scenario: $0.07000 - $0.07817 (with widespread adoption of blockchain in music rights management)

- Transformative scenario: $0.08000 - $0.10000 (revolutionary changes in the music industry business model)

- 2030-12-31: AUDIO $0.06986 (74% increase from 2025, indicating significant market maturation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04276 | 0.03996 | 0.02917 | 0 |

| 2026 | 0.05749 | 0.04136 | 0.02151 | 3 |

| 2027 | 0.07068 | 0.04942 | 0.02965 | 23 |

| 2028 | 0.06305 | 0.06005 | 0.04804 | 50 |

| 2029 | 0.07817 | 0.06155 | 0.04678 | 54 |

| 2030 | 0.07615 | 0.06986 | 0.05729 | 74 |

IV. Professional Investment Strategies and Risk Management for AUDIO

AUDIO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in decentralized music platforms

- Operational advice:

- Accumulate AUDIO tokens during market dips

- Stake tokens to participate in network governance and earn rewards

- Store tokens securely in hardware wallets or reputable custodial services

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor overall crypto market sentiment and correlations with major cryptocurrencies

- Pay attention to Audius platform adoption metrics and user growth

AUDIO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio, depending on risk tolerance

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets and traditional markets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Audius wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for AUDIO

AUDIO Market Risks

- Volatility: Cryptocurrency markets are highly volatile, leading to significant price fluctuations

- Competition: Emerging decentralized music platforms may challenge Audius' market position

- Adoption: Slow user adoption could impact token value and platform growth

AUDIO Regulatory Risks

- Uncertain regulations: Evolving cryptocurrency regulations may impact AUDIO's legal status

- Copyright issues: Potential legal challenges related to music licensing and copyright infringement

- Cross-border restrictions: International regulations may limit AUDIO's global accessibility

AUDIO Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the underlying smart contracts

- Scalability challenges: Possible network congestion as user base grows

- Blockchain interoperability: Limitations in cross-chain functionality may hinder growth

VI. Conclusion and Action Recommendations

AUDIO Investment Value Assessment

AUDIO presents a unique opportunity in the decentralized music streaming space, with long-term potential for disrupting the traditional music industry. However, short-term volatility and regulatory uncertainties pose significant risks.

AUDIO Investment Recommendations

✅ Beginners: Start with small, affordable investments to understand the market dynamics ✅ Experienced investors: Consider a moderate allocation within a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence and consider AUDIO as part of a broader blockchain technology investment strategy

AUDIO Trading Participation Methods

- Spot trading: Buy and sell AUDIO tokens on Gate.com

- Staking: Participate in network governance and earn rewards by staking AUDIO tokens

- DeFi integration: Explore decentralized finance opportunities involving AUDIO tokens, if available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high can Audius go?

Audius reached an all-time high of $4.99 in March 2021. While future price potential is uncertain, some analysts predict it could reach $10-$15 in the next bull run, depending on market conditions and project developments.

What is Audius prediction for 2025?

Audius is predicted to reach a maximum price of $3.64 and a minimum of $2.33 by the end of 2025, based on current market analysis.

Is AMP going to skyrocket?

AMP is expected to see a modest increase, reaching $0.002394 by November 2025. While not skyrocketing, it shows potential for steady growth based on current trends and technical indicators.

Will AMP reach 10 cents?

Yes, AMP reached 10 cents by October 2025, aligning with earlier predictions for the token's growth.

Share

Content