2025 ANIME Price Prediction: Soaring Heights or Market Correction for the Popular Crypto Token?

Introduction: ANIME's Market Position and Investment Value

Animecoin (ANIME), as a cultural token for the global anime industry, has been transforming the anime sector into a community-owned creative network since its inception. As of 2025, ANIME's market cap has reached $51,215,477, with a circulating supply of approximately 5,538,604,656 tokens, and a price hovering around $0.009247. This asset, dubbed the "Culture Coin of anime," is playing an increasingly crucial role in powering a digital economy for anime enthusiasts worldwide.

This article will provide a comprehensive analysis of ANIME's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ANIME Price History Review and Current Market Status

ANIME Historical Price Evolution

- 2025 January: ANIME reached its all-time high of $0.12, marking a significant milestone for the project.

- 2025 October: The price experienced a sharp decline, hitting its all-time low of $0.00509.

- 2025 Q4: Market volatility continues, with the price fluctuating between the historical high and low points.

ANIME Current Market Situation

As of October 24, 2025, ANIME is trading at $0.009247, representing a 1.81% increase in the last 24 hours. The token has a market capitalization of $51,215,477, ranking it 610th in the overall cryptocurrency market. Despite the recent daily gain, ANIME has experienced significant losses over longer time frames, with a 35.72% decrease in the past 30 days and a substantial 93.34% decline over the past year. The current price is notably lower than its all-time high of $0.12, recorded in January 2025. The token's 24-hour trading volume stands at $926,813, indicating moderate market activity. With a circulating supply of 5,538,604,656 ANIME tokens and a total supply of 10 billion, the project has a circulating supply ratio of approximately 55.39%.

Click to view the current ANIME market price

ANIME Market Sentiment Indicator

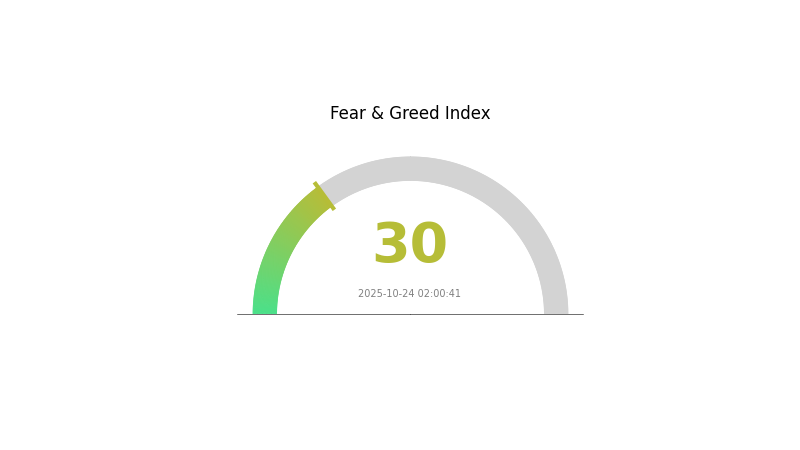

2025-10-24 Fear and Greed Index: 30 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 30, indicating a state of fear. This suggests investors are wary and potentially seeking safer options. However, for contrarian traders, periods of fear often present buying opportunities. As always, it's crucial to conduct thorough research and manage risk carefully. Keep an eye on market trends and fundamental developments to make informed decisions in this uncertain climate.

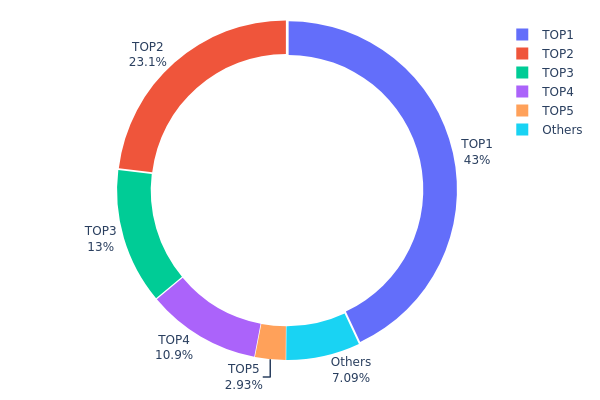

ANIME Holdings Distribution

The address holdings distribution for ANIME reveals a highly concentrated ownership structure. The top address holds 43.01% of the total supply, while the top 5 addresses collectively control 92.88% of all ANIME tokens. This level of concentration raises concerns about centralization and potential market manipulation.

Such a concentrated distribution could lead to significant price volatility if large holders decide to sell their positions. It also suggests that a small number of entities have substantial influence over the token's governance and market dynamics. This concentration may deter some investors due to perceived risks of price manipulation or sudden supply shocks.

From a market structure perspective, the current distribution indicates a low level of decentralization for ANIME. While this may provide some stability in the short term, it could pose long-term risks to the token's ecosystem development and broader adoption. Potential investors should carefully consider these factors when evaluating ANIME's market structure and on-chain stability.

Click to view the current ANIME Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xcee2...97180d | 4301382.48K | 43.01% |

| 2 | 0x1a14...540415 | 2305781.37K | 23.05% |

| 3 | 0x6ae7...a7040a | 1300000.00K | 13.00% |

| 4 | 0x2d87...ffe258 | 1090789.22K | 10.90% |

| 5 | 0xf977...41acec | 292714.51K | 2.92% |

| - | Others | 709332.41K | 7.12% |

II. Key Factors Affecting ANIME's Future Price

Supply Mechanism

- IP Licensing: The cost of acquiring and maintaining IP licenses significantly impacts profitability.

- Historical Pattern: High-profile IPs like Ultraman have historically driven revenue and market share.

- Current Impact: Diversification of IP portfolio (e.g., My Little Pony) is expected to reduce dependency on single IPs.

Institutional and Major Player Dynamics

- Corporate Adoption: Companies like Guangdong Jintian Animation are leading in the IP-based snack food industry.

- National Policies: Government regulations on IP licensing and food safety standards may influence the market.

Macroeconomic Environment

- Inflation Hedging Properties: As a consumer discretionary product, ANIME-related items may be sensitive to inflationary pressures.

Technological Development and Ecosystem Building

- Product Innovation: Continuous development of new IP-based snack products to meet consumer preferences.

- Ecosystem Applications: Integration of IP across various product categories (candy, biscuits, chocolate, seaweed snacks) creates a comprehensive ecosystem.

III. ANIME Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00583 - $0.00925

- Neutral forecast: $0.00925 - $0.01078

- Optimistic forecast: $0.01078 - $0.01231 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range predictions:

- 2027: $0.00747 - $0.01343

- 2028: $0.00887 - $0.01435

- Key catalysts: Increasing adoption and ecosystem development

2029-2030 Long-term Outlook

- Base scenario: $0.01370 - $0.01521 (assuming steady market growth)

- Optimistic scenario: $0.01521 - $0.02159 (assuming strong ecosystem expansion)

- Transformative scenario: $0.02159+ (extreme favorable market conditions)

- 2030-12-31: ANIME $0.02159 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01231 | 0.00925 | 0.00583 | 0 |

| 2026 | 0.01455 | 0.01078 | 0.00873 | 16 |

| 2027 | 0.01343 | 0.01267 | 0.00747 | 36 |

| 2028 | 0.01435 | 0.01305 | 0.00887 | 41 |

| 2029 | 0.01671 | 0.0137 | 0.00986 | 48 |

| 2030 | 0.02159 | 0.01521 | 0.01475 | 64 |

IV. ANIME Professional Investment Strategy and Risk Management

ANIME Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Anime enthusiasts and long-term blockchain believers

- Operation suggestions:

- Accumulate ANIME tokens during market dips

- Participate in community governance to increase token value

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Determine overbought or oversold conditions

- Key points for swing trading:

- Monitor anime industry news and partnerships

- Set stop-loss orders to manage downside risk

ANIME Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ANIME

ANIME Market Risks

- High volatility: Cryptocurrency markets are known for extreme price swings

- Competition: Other anime-related tokens may emerge and compete for market share

- Liquidity risk: Limited trading volume may lead to slippage during large trades

ANIME Regulatory Risks

- Uncertain regulatory environment: Cryptocurrency regulations vary by country and are subject to change

- Token classification: Potential for ANIME to be classified as a security in some jurisdictions

- Cross-border transactions: Compliance challenges with international money transfer regulations

ANIME Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying smart contract

- Scalability issues: Possible network congestion on Ethereum or Arbitrum chains

- Wallet security: Risk of hacks or user errors leading to loss of tokens

VI. Conclusion and Action Recommendations

ANIME Investment Value Assessment

ANIME presents a unique opportunity in the intersection of anime and blockchain technology. While it offers long-term potential in revolutionizing the anime industry, investors should be aware of short-term volatility and regulatory uncertainties.

ANIME Investment Recommendations

✅ Beginners: Start with small investments and focus on learning about the project and technology ✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading strategies ✅ Institutional investors: Conduct thorough due diligence and consider ANIME as part of a diversified crypto portfolio

ANIME Trading Participation Methods

- Spot trading: Buy and sell ANIME tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- Community engagement: Join official ANIME channels to stay informed and contribute to the ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will ANIME coin hit 1 dollar?

Based on current market trends and predictions, it's highly unlikely that ANIME coin will reach $1 by 2025. The coin would need to see unprecedented growth to achieve this price point.

What is the price prediction for the ANIME coin?

ANIME is predicted to reach $0.006935 by November 20, 2025, representing a 24.77% decrease from current levels.

Does API3 have a future?

Yes, API3 has a promising future. Its unique oracle model and increasing blockchain adoption position it for long-term growth and success.

What is the price prediction for AIOZ in 2040?

Based on current forecasts, AIOZ price is expected to range between $3.63 and $9.77 by 2040.

Share

Content