Post content & earn content mining yield

placeholder

ImpermanentLossEnjoyer

- Reward

- like

- Comment

- Repost

- Share

Amid the turbulence in the crypto assets market, I firmly believe in the potential of the Ethereum ecosystem, which stems from my in-depth experience with the Base chain. My actual participation in the blockchain infrastructure over the past two years has made me realize that truly viable projects are not limited to certain popular public chains, but are foundational infrastructures like Base, along with related DEX, Polymarket, and HYPE application ecosystems.

Deep involvement in Blockchain projects requires a significant investment of time and energy. For example, I tested multiple small pro

View OriginalDeep involvement in Blockchain projects requires a significant investment of time and energy. For example, I tested multiple small pro

- Reward

- 12

- 6

- Repost

- Share

SatoshiSherpa :

:

Relying on early experiences to rest on past achievementsView More

- Reward

- like

- Comment

- Repost

- Share

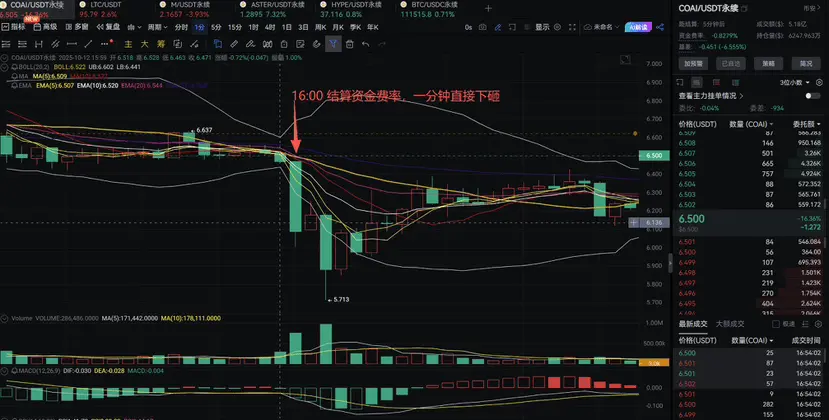

Recently, I conducted a rather risky experiment in crypto assets derivatives trading. The goal was to take advantage of the abnormally high negative funding rate (-2% every 4 hours) near the settlement time for arbitrage. I chose the COAI coin as the test subject.

On the eve of settlement, I opened a long position, intending to gain funding rate income. Sure enough, at 16:00, I received a funding rate of 49 dollars as I wished. However, just one minute later, the market experienced severe fluctuations. The price of COAI plummeted from 6.52 dollars to 6.08 dollars, instantly putting my position

On the eve of settlement, I opened a long position, intending to gain funding rate income. Sure enough, at 16:00, I received a funding rate of 49 dollars as I wished. However, just one minute later, the market experienced severe fluctuations. The price of COAI plummeted from 6.52 dollars to 6.08 dollars, instantly putting my position

COAI-22.27%

- Reward

- 9

- 5

- Repost

- Share

ser_we_are_ngmi :

:

Stable loser player learns a lesson onlineView More

- Reward

- like

- Comment

- Repost

- Share

#美联储降息预期 Favorable Information has come from the market! The mainstream Crypto Assets market shows obvious signs of warming up, with Bitcoin and Ethereum both recording strong pumps this morning. The technical indicators show that long positions are regaining control of the market trend.

From a technical analysis perspective, the daily charts of these two major Crypto Assets are impressive, successfully breaking through and stabilizing above the key 120-day moving average, while their weekly performance is also robust, firmly holding above the 20-week moving average. This technical pattern in

View OriginalFrom a technical analysis perspective, the daily charts of these two major Crypto Assets are impressive, successfully breaking through and stabilizing above the key 120-day moving average, while their weekly performance is also robust, firmly holding above the 20-week moving average. This technical pattern in

- Reward

- 14

- 7

- Repost

- Share

GasFeePhobia :

:

Suckers have exercised in the grass, and the physical sensation is not bad.View More

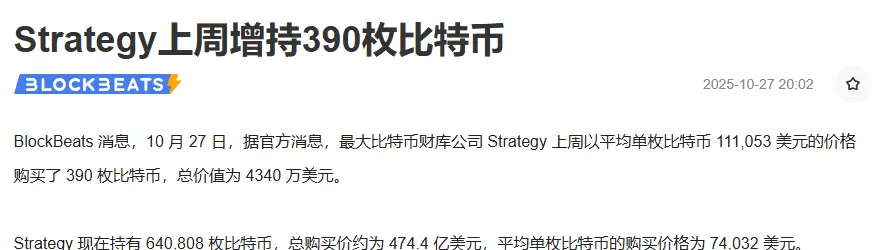

MicroStrategy purchased another 390 Bitcoins last week, worth over $43.3 million, with an average buying price of about $111,053 per Bitcoin.

As of now, MicroStrategy holds a total of 640,808 Bitcoins, with an average purchase price of about 74,032 USD per Bitcoin, resulting in a total profit of approximately 4.74 billion USD.

As of now, MicroStrategy holds a total of 640,808 Bitcoins, with an average purchase price of about 74,032 USD per Bitcoin, resulting in a total profit of approximately 4.74 billion USD.

BTC0.31%

- Reward

- like

- Comment

- Repost

- Share

#数字货币市场回升 A significant breakthrough in financial history! Global top investment bank JPMorgan Chase officially announces the acceptance of Bitcoin and Ether as loan Collateral. This decision marks a historic integration of TradFi and the digital asset space.

[Analysis of Decision Significance]

• Holding digital assets can directly access financing channels without the need to liquidate cryptocurrencies.

• Traditional financial giants have provided unprecedented trust endorsement for digital assets.

• This move is likely to trigger a chain reaction in the financial sector, with more mainstrea

View Original[Analysis of Decision Significance]

• Holding digital assets can directly access financing channels without the need to liquidate cryptocurrencies.

• Traditional financial giants have provided unprecedented trust endorsement for digital assets.

• This move is likely to trigger a chain reaction in the financial sector, with more mainstrea

- Reward

- 6

- 4

- Repost

- Share

OnChainArchaeologist :

:

I said earlier that my coin is still in my hand, this wave is short.View More

#巨鲸动向 Are you curious how Liangxi can turn a 10,000 principal into 10 million? The answer lies in the rollover strategy, a trading method that was already adeptly employed by traders like Tony five years ago. He started with 50,000 and rose to 20 million within a year, becoming a well-known figure in the crypto world alongside Liangxi and Hanbalongwang.

Rollover is essentially using small funds for multiple trial and error, achieving capital multiplication through high leverage amidst market fluctuations. It sounds exciting, but its core lies in risk control, accurate judgment, and strict exec

View OriginalRollover is essentially using small funds for multiple trial and error, achieving capital multiplication through high leverage amidst market fluctuations. It sounds exciting, but its core lies in risk control, accurate judgment, and strict exec

- Reward

- 17

- 7

- Repost

- Share

ForkTrooper :

:

This low-level Be Played for Suckers method has been used to death.View More

What is Piggycell? Animoca Brands leads a $10 million financing round, an analysis of the value of the DePIN + RWA track newcomer.

On October 15, 2025, South Korea's shared power bank giant Piggycell officially completed its token generation event (TGE), combining its vast offline business with a blockchain economic model, becoming one of the most noteworthy cases in the DePIN (Decentralized Physical Infrastructure Network) track. With a 95% market share in South Korea, 4 million paying users, and a multi-million dollar investment from Animoca Brands, is this project truly a disruptive innovation, or just another overhyped Web3 concept? This article will delve into its business model, token economy, and potential risks based on existing public information.

- Reward

- like

- Comment

- Repost

- Share

#中美贸易磋商 The ten-year fluctuation of the Crypto Assets market has taught me a profound lesson: being overly focused on the 1-minute Candlestick Chart may be the beginning of losses. There was a time when I was also that trader who stared at the screen, my heartbeat rising and falling with the short-term fluctuations; either missing the ideal buying point or selling too early, resulting in unsatisfactory outcomes.

It wasn't until a market veteran pointed out that the core of my problem lay in the limitations of single time period analysis that I began to change my strategy. Today, I want to

View OriginalIt wasn't until a market veteran pointed out that the core of my problem lay in the limitations of single time period analysis that I began to change my strategy. Today, I want to

- Reward

- 6

- 5

- Repost

- Share

bridgeOops :

:

Stop analyzing so much, just do it.View More

XRP Today News: Evernorth bought 1 billion dollars in a week, unrealized gains exceed 75 million.

Less than a week after its debut, the newly established financial company Evernorth, focused on XRP, has already become one of the most profitable institutional participants in the crypto assets space. Today's news on XRP reveals that the company has quickly accumulated nearly $1 billion worth of XRP and has generated approximately $75 million in unrealized gains, indicating that Wall Street may have quietly begun to pivot towards the token.

XRP2.14%

Last edited on 2025-10-28 01:00:14

- Reward

- like

- Comment

- Repost

- Share

Recently, the Bitcoin market has shown new dynamics. A large institutional investor invested more than 43 million dollars again last week, increasing their holdings by 390 Bits. This behavior of continuously buying at high prices conveys a clear signal to the market: the possibility of a significant fall in Bitcoin is dropping.

However, for ordinary investors, the current market environment has changed significantly. Institutions and large funds are steadily accumulating Bit, while many retail investors choose to sell during price fluctuations. The nature of this 'silent bull market' i

However, for ordinary investors, the current market environment has changed significantly. Institutions and large funds are steadily accumulating Bit, while many retail investors choose to sell during price fluctuations. The nature of this 'silent bull market' i

BTC0.31%

- Reward

- 7

- 4

- Repost

- Share

WenMoon :

:

No one can outrun big capital.View More

Load More

Join 40 million users in our growing community

⚡️ Join 40 million users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

- Trending TopicsView More

5.2K Popularity

18.6K Popularity

61K Popularity

8.3K Popularity

21.6K Popularity

- Hot Gate FunView More

- MC:$1.2MHolders:5291

- MC:$468KHolders:10606

- MC:$452.4KHolders:22772

- MC:$67.7KHolders:20400

- MC:$620.2KHolders:138

- Pin

- 📈 Market Insights Weekly: Weekly Forecast Challenge

This Week’s Theme: #WillBTCHit120K

📅 Event Period: Oct 28 – Nov 2, 24:00 (UTC+8)

💡 What to Do:

Share your market view on this week’s theme: #WillBTCHit120K ?

👉 Explain your reasoning—whether through technical analysis, macro trends, on-chain data, or market sentiment. Show your unique insight!

🏆 Rewards (Total $1000 in Position Vouchers)

🥇 Top Insight (3 winners): $150 position voucher

🥈 Excellent Analysis (6 winners): $50 position voucher

🥉 Active Analyst (10 winners): $25 position voucher

✍️ How to Participate:

1️⃣ Follow @Gate_Squ - 🚀 #GateNewbieVillageEpisode4 ✖️ @比特一哥

📈 Follow the trend, pick your points, wait for the signal

💬 Share your trading journey | Discuss strategies | Grow with the Gate Family

⏰ Event Date: Oct 25 04:00 – Nov 2 16:00 UTC

How to Join:

1️⃣ Follow Gate_Square + @比特一哥

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode4

3️⃣ Share your trading growth, insights, or experience

— The more genuine and insightful your post, the higher your chance to win!

🎁 Rewards

3 lucky participants → Gate X RedBull Cap + $20 Position Voucher

If delivery is unavailable, replaced with a $30 Position V - 💥 Gate Square Event: #PostToWinCGN 💥

Post original content on Gate Square related to CGN, Launchpool, or CandyDrop, and get a chance to share 1,333 CGN rewards!

📅 Event Period: Oct 24, 2025, 10:00 – Nov 4, 2025, 16:00 UTC

📌 Related Campaigns:

Launchpool 👉 https://www.gate.com/announcements/article/47771

CandyDrop 👉 https://www.gate.com/announcements/article/47763

📌 How to Participate:

1️⃣ Post original content related to CGN or one of the above campaigns (Launchpool / CandyDrop).

2️⃣ Content must be at least 80 words.

3️⃣ Add the hashtag #PostToWinCGN

4️⃣ Include a screenshot s - Are you a true GT Holder? 😎

Take a look — which one is the real GT? 💎

💰 Join the fun! 5 lucky users will each win a $10 Position Voucher!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 31, 2025, 24:00 (UTC+8) - 🎒 Gate Square “Blue & White Travel Season” Merch Challenge is here!

📸 Theme: #GateAnywhere🌍

Let’s bring Gate’s blue and white to every corner of the world.

— Open the gate, Gate Anywhere

Take your Gate merch on the go — show us where blue and white meet your life!

At the office, on the road, during a trip, or in your daily setup —

wherever you are, let Gate be part of the view 💙

💡 Creative Ideas (Any style, any format!)

Gate merch displays

Blue & white outfits

Creative logo photography

Event or travel moments

The more personal and creative your story, the more it shines ✨

✅ How to Partici