How many different kinds of crypto Futures are there, and what are their differences?

A. Common types of crypto Futures

As the quantity and size of market players increased, the entire crypto asset industry developed at an astonishing rate, as did the crypto futures trading market. According to the data of relevant institutions, “the size of the crypto asset contract market has exceeded one trillion US dollars”. There are two sorts of crypto futures that are most prevalent on the market:

- Perpetual Contract

a. Concept: Gate.io perpetual contract is a derivative product of encrypted assets. Users can predict the price trend and then choose to buy long or sell short to obtain the benefits from the ups and downs of the prices.

b. Difference between contract and spot

c. The difference between perpetual contracts and traditional futures contracts

d. The difference between USDT-M perpetual contracts and Currency-M perpetual contracts

2.Delivery contract

The Gate.io delivery contract is a derivative of a crypto asset that can only be settled at the moment in USDT (U-Margin) and BTC (BTC-Margin).

A delivery contract stipulates that the underlying asset must be bought and sold at the agreed-upon price on the scheduled delivery day (which may fall on the same week, the following week, or the current quarter). It, unlike the perpetual contract, has a delivery date (i.e. the maturity date). Both the buyer and the seller are obligated to perform the contract and complete the delivery at the maturity date.

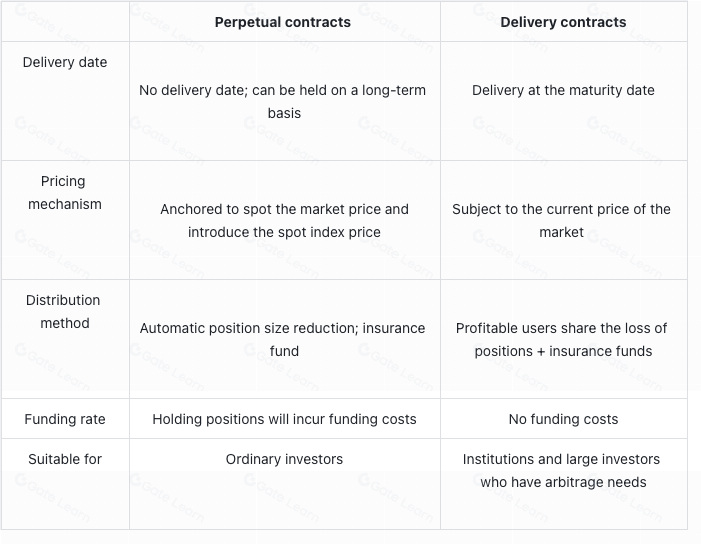

B. What is the difference between perpetual contracts and delivery contracts?

The difference between the two:

C. Conclusion

Perpetual contracts and delivery contracts are the two types of futures that are mostly traded in the crypto asset contract markets. Perpetual contracts dominate the market because of their simple operations, the capability of being held on a long-term basis, and their mature market mechanisms, while delivery contracts are frequently used in arbitrage trades by big institutional investors.

For more information about the trade of perpetual contracts, please visit the Gate.io Futures platform and click to register.

Disclaimer

This article is for informational purposes only, and any contents provided herein do not constitute investment advice, nor is Gate.io responsible for any of your investments. Contents such as technical analysis, market judgment, trading skills, and trader sharing may be subject to potential risks, investment variables, and uncertainties. This article does not suggest or imply any opportunities with guaranteed returns.

Related Articles

Perpetual Contract Funding Rate Arbitrage Strategy in 2025

What is Aevo? All you need to know about AEVO token (2025)

Understanding The Moving Average

Detailed Explanation of Granville 8 Rules (Updated 2025)

Introduction to Funding Rate Arbitrage Quantitative Funds